Despite being the most common inherited blood disorder in the United States, sickle cell disease (SCD) has historically been neglected by the drug industry. But with a global market that hit $2.2 billion in 2021 — and estimated to grow 17.3% per year until 2027 — what was once an area that drew scant attention is now generating substantial interest from those with deep pockets.

In early August, Pfizer announced a $5.4 billion acquisition deal with Global Blood Therapeutics Inc., (GBT), a biopharmaceutical company that has been developing treatments for SCD since its founding in 2011. According to Ted Love, president and CEO of GBT, the acquisition, when complete, will extend GBT’s reach and accelerate both its mission and its ability to reach underserved people with SCD around the world.

“Pfizer will broaden and amplify our impact for patients and further propel much-needed innovation and resources for the care of people with sickle cell disease and other rare diseases, including populations in limited-resource countries,” he says.

A full spectrum approach

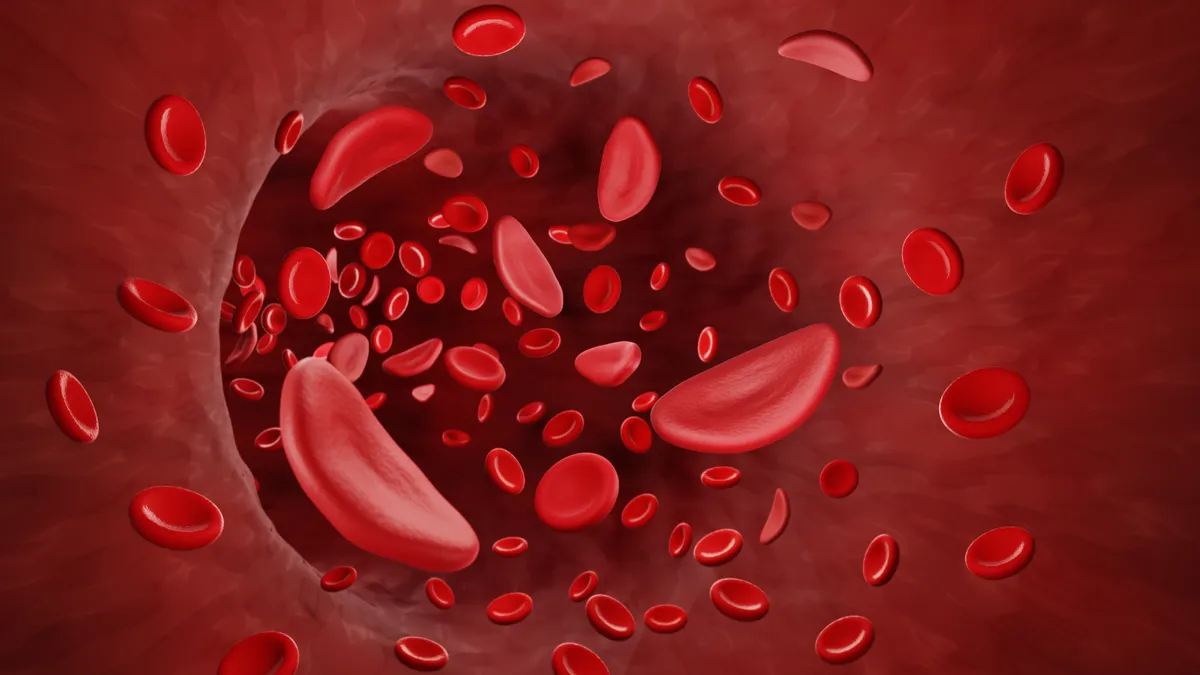

SCD is a hereditary condition marked by malformations in red blood cells and can vary greatly in severity from person to person. The blood cells that form a crescent — or sickle — shape are prone to premature death, which can lead to anemia. These misshapen cells may also trigger inflammation and blockages in the blood vessels, leading to a condition called a vaso-occlusive crisis (VOC), impaired blood flow that can trigger tissue damage, severe pain and other serious complications, including stroke.

Symptoms of SCD start early in life, and are not only debilitating, but lead to long-term organ damage, most often affecting the lungs, eyes, spleen, kidneys and liver, potentially shortening a person’s life expectancy. In the U.S., SCD is most common among Black Americans, occurring in one of every 365 births. People with Middle Eastern and South Asian ancestry are also susceptible to the disease and some 45 million people around the world carry a gene for the condition, which they can pass along to their children.

Better treatments for SCD are needed not only to manage symptoms, but to prevent long-term complications.

Increasing access

Love sees the Pfizer acquisition of GBT as a way to further the company’s long-standing mission.

“For decades, the sickle cell disease community has been profoundly underserved, and there have been limited treatment options for patients with their whole lives ahead of them,” he says. “GBT is proud to lead the development of new medicines to address the inadequacies of care for SCD patients.”

In addition to its research efforts, GBT has also aimed to provide support and to give back to the sickle cell community. The company has been guided by a belief in every person having an equal chance to reach their full health potential, Love says. “We look forward to the opportunity to continue the development of innovative therapies with the potential to transform this devastating disease into a manageable chronic condition.”

By joining forces with Pfizer, Love anticipates that more people will be able to benefit from GBT’s efforts to improve SCD care.

“Pfizer will broaden and amplify our impact for patients and further propel much-needed innovation and resources for the care of people with sickle cell disease and other rare diseases, including populations in limited-resource countries,” he says. “We look forward to working together with Pfizer to serve our communities and advance our shared goal of improving health equity and expanding access to life-changing treatments to create a healthier future for all.”

Besides Pfizer, Novartis is the only other pharma giant involved in sickle cell development— the Swiss company teamed up with the Bill & Melinda Gates Foundation last year to develop a one-off gene therapy to cure the disease.

New drugs on the horizon

Most current treatments for SCD today primarily help to relieve symptoms. Bone marrow transplants can cure the condition — but because of the risks involved, they’re typically performed only in children with a severe form of the disease. But research is helping to present the some 20 to 25 million people worldwide and 100,000 people in the U.S. who have SCD with new options. A number of companies are working on treatments for SCD including some exploring gene editing technology.

GBT’s primary SCD drug is Oxbryta, which was approved in 2019. Oxbryta was the first drug in its class, targeting the underlying cause of the blood cell abnormalities seen in SCD.

And the company has some important updates waiting in the wings. The drug GBT601, currently in a phase 2/3 trial, aims to reduce the severity or frequency of blood cell death and impaired blood flow. GBT also has inclacumab in phase 3. The fully human monoclonal antibody targets the protein P-selectin, aiming to reduce VOC in particular to prevent hospitalization.

Regulators understand the impact that SCD has and the need for new treatments — the FDA granted both GBT601 and inclacumab orphan drug and rare pediatric disease designations.

If approved, it’s estimated that these drugs and Oxbryta could together surpass $3 billion in global sales. Oxbryta alone saw net sales of $195 million in 2021