The times, they are a-changin’ — and in healthcare you’re either a “believer” in the next wave of innovation or a “non-believer” too firmly entrenched in the traditional ways of doing business, according to a new report from PwC.

In embracing a “$1 trillion opportunity” for reinvention, the future is for the believers, PwC pharmaceutical and life sciences lead Philip Sclafani said. And in terms of pharma’s role in that healthcare transformation, the answer lies in R&D efficiency and business diversification.

With a U.S. healthcare system that carries more than $5 trillion in spending each year, PwC’s report said that $1 trillion of that spending is expected to shift “away from fragmented, infrastructure-heavy models and toward empowered ‘super consumers’ and a digital-first, proactive and personalized system of care.”

For drugmakers, a rearrangement of that magnitude means stepping outside the comfort zone of conventional revenue streams toward ones that embrace efficiency and self-sustainability, Sclafani said.

“One hundred percent of every company’s revenue is in the model that we have today, and that’s the first barrier,” Sclafani said. “There’s a conservative nature to want to hold on to what works and where the revenue is and report quarterly those results to the Street and the markets, but there’s got to be a willingness to gradually evolve.”

From disruptive technological advances to changing consumer models in the larger healthcare arena, Sclafani said pharma companies need to stop trying to be everything to everyone and embrace the consumer-driven, segmented markets taking shape.

Three critical factors

Driving a massive shift to incentivize efficiency in healthcare are three factors, Sclafani said: better understanding of science, technology and biology; rapid, exponential adoption of tools like AI, robotics and monitoring; and rising inflation of medical costs at about 8% per year.

For drugmakers, these factors can guide toward improvements in how R&D is accomplished and how products reach patients, he said.

“There are better ways to discover molecules at scale, and rapidly test and prototype products — what once took months or years now takes minutes,” Sclafani said. “Getting potential compounds all the way from concepts into a patient is the next frontier, and with the next wave making clinical trials faster and reducing failure rates, we’re starting to see a major shift.”

With healthcare costs at $5 trillion, or 18% of U.S. GDP as of 2024, drugs aren’t the main culprit, but they represent an opportunity to find efficiencies in the system, according to the report. Investment in AI drug discovery, already underway, could lead to breakthroughs in precision medicine and more effective care that drives down costs across the system, Sclafani said.

By 2035, PwC expects $1 trillion of that spending to fall away from administrative overhead and brick-and-mortar facilities and into AI-driven care models.

Pharma companies of the future will boast “AI-first operations across the value chain,” according to the report, leading to better risk assessment, diagnostics and treatments. Drugmakers who adopt these technologies will cut waste and increase efficacy.

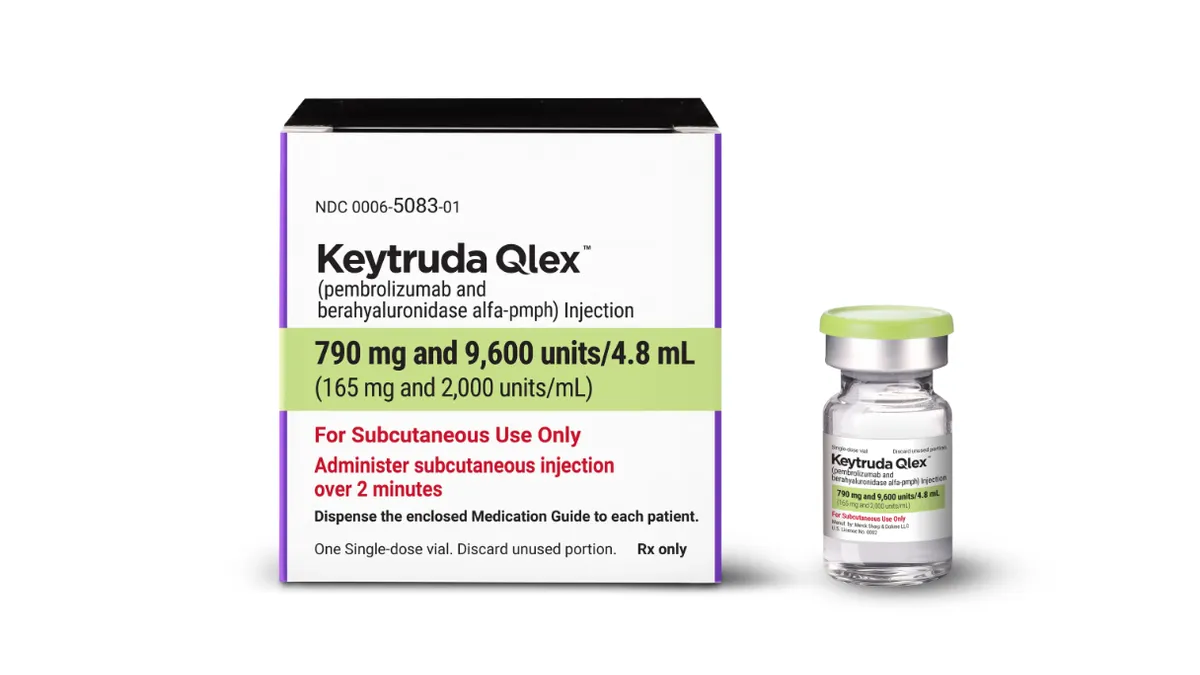

They will also embrace changes to conventional consumer models. Innovations like direct-to-consumer sales of GLP-1 medications, for example, show a willingness to think outside the box of selling to a wholesaler and then reaching patients through pharmacies and PBMs, Sclafani said. Other drugs like anticoagulants and multiple sclerosis therapies are joining the DTC fray, and “it just makes sense as a way to monetize innovative assets,” he said.

Changing incentives

Where much of these mindset changes often take root is in early science from biotech startups and academic institutions, which are historically the places to take bigger risks for potentially bigger rewards.

But that’s changing.

“That engine is a little bit broken right now by public funding cuts at NIH, and the challenges in the biotech model,” Sclafani said. “It’s another one of the risks.”

According to PwC’s report, pharma and the healthcare industry as a whole are at an inflection point. Leaders who preserve their business models for the short-term will be squeezed out by faster-paced competitors.

The ones who adapt to the efficiencies becoming widely available at an exponential rate will take advantage of longer-term growth opportunities.