In the context of the COVID-19 vaccine sprint, Novavax has long been characterized as an early front-runner that stumbled late across the approvals finish line due to various regulatory and manufacturing delays. But if you ask Novavax, this race is far from over.

The Maryland-based company, which had two decades of vaccine development experience before COVID-19 hit, won an emergency use authorization for its protein-based recombinant nanoparticle technology vaccine last July, which was then OK’d as a booster in October.

Yet, as new variants emerge and the country settles into a long-term and potential annual booster strategy, Novavax maintains there’s plenty of room to gain a steady foothold in the space.

So far, Novavax has pulled in about $2 billion in revenue for its vaccine, which is the first product the company has ever commercialized. And at this year’s J.P. Morgan Healthcare Conference, John Trizzino, the company’s chief commercial officer, said that as the vaccine landscape shifts from government contracts to an open commercial marketplace, Novavax is poised to tap into new revenue potential for its jab that could reach between $15 billion to $18 billion.

But to pull this off, several factors will have to fall into place. That’s why Dr. Gregory Glenn, Novavax’s president of R&D, said the company has been tuning out peripheral noise — such as its sinking stock price — and keeping a “laser focus” on testing and potentially launching new versions of its shot.

“COVID is still killing 3,000 people in the U.S. each week. So (our focus) has to be on giving customers what they want with COVID vaccine.”

Dr. Gregory Glenn

President of research and development, Novavax

“We are focused on providing people what’s been missing for tamping down COVID, which is a really good recombinant vaccine,” he said. “It’s going to be a really big year for us.”

PharmaVoice caught up with Glenn at JPM to discuss how the company plans to build on its approval and deploy a long-game strategy he believes will stack up well against the mRNA competition.

Grappling with variants

The newest subvariant of COVID-19 sweeping across the U.S. — XBB.1.5 — is thought to be one of the most contagious and genetically diverse omicron subvariants yet.

“Biologically it represents a big departure from previous strains,” Glenn said. “It’s highly infectious and escaping immunity effectively. This is a bad player that’s taking over.”

Although research is ongoing into how effective the current COVID-19 vaccines and booster are at fighting XBB.1.5, early signals from studies suggest that protection against the rapidly spreading subvariant is low. But given how the virus is evolving, Glenn said the “real question is how we do against the forward drifts.”

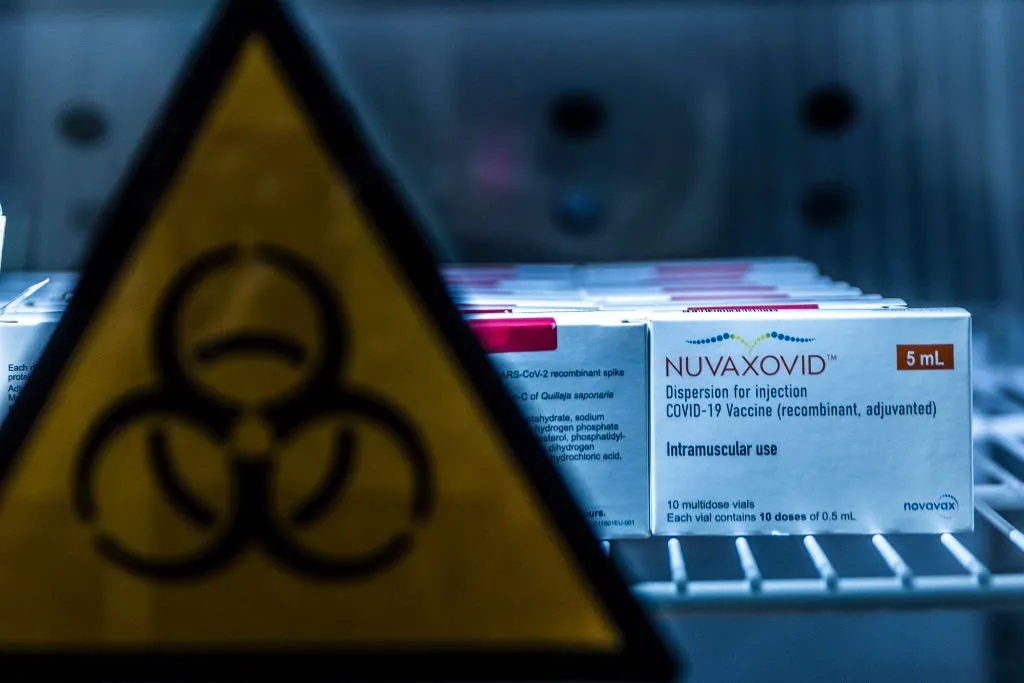

In addition to its approved NVX-COV2373 vaccine (Nuvaxovid), which the company refers to as its “prototype vaccine,” Novavax also has an omicron or BA.1-specific variant shot (NVX-CoV2515) in late-stage trials. Data released in November showed that this newer BA.1-specific shot was more effective than the prototype vaccine in creating a neutralizing response in people “not previously exposed to COVID-19.” Armed with this data, Novavax said it has an option to switch to a variant-specific shot if needed. Still, Glenn said that its prototype version has also fared well against forward drifts of the virus because of the spike hematology.

“Today's results show that use of our prototype vaccine as a booster induces cross-reactive responses to a broad range of variants with the potential to protect against future strains,” Glenn said of the November results in a statement. “This is a hallmark of our vaccine technology and shows the suitability of our current prototype vaccine as a booster even as the COVID-19 landscape continues to evolve."

Regulatory hurdles

On Jan. 26, Novavax will be one of the manufacturing presenters at the FDA’s Vaccines and Related Biological Products Advisory Committee meeting, which will tackle recommendations for future vaccine regimens and should be an “informative discussion,” Glenn said.

Having a seat at the regulatory table is crucial for Novavax, especially as it works with the agency to modify its booster recommendations.

“The reason there hasn’t been wide uptake of our vaccine in our view is that the FDA has continued to make restrictions around its recommendations for use,” Glenn explained, referring to guidelines stipulating that patients could receive a Novavax shot as a booster if they’d received a primary course of an mRNA shot from Pfizer-BioNTech or Moderna — but only if they hadn’t been given an mRNA booster.

“So the FDA had quite restrictive language around our vaccine,” he said. “We have provided info (to the FDA and) we’re looking forward to that being lifted.”

A new norm for adults

In addition to getting regulators on board, Novavax is hoping to ride a changing tide in American culture toward annual vaccinations for adults — a shift that’s accelerated during the pandemic.

“Adult immunization is relatively new,” Glenn said. “The benefits in the last 20 to 30 years have come to the forefront. And in some places, like India, nobody did vaccines before COVID, so it’s going to be interesting to see the market develop.”

But Novavax isn’t just looking to be a go-to for COVID-19 boosters. In December, the company initiated a phase 2 dose-confirming trial for its combined flu and COVID-19 shot to test its safety and efficacy. Glenn said the company could have data to report from that trial by the summer, and if demand for a combined shot increases, Novavax will be “well positioned” to provide that option.

“I think there is going to be a push to have these multivalent platforms for COVID and the flu,” Glenn said.

Although other major vaccine players like Moderna are also testing their tech in the flu space, Glenn said Novavax’s recombinant technology could give it an edge because it requires a lower dose, is based on more traditional vaccine technology, and could have a gentler side-effect profile.

“Providers don’t like to manage fever and sore arms,” he said.

Because regulatory and market barriers will “fall away” and demand for shots — and in particular, Novavax’s technology — could increase, Glenn said the company is “well positioned to get utilization” for its vaccine “way up.”

A turning point

At JPM, Novavax revealed that its longtime CEO, Stan Erck, is retiring, and that Harmony Biosciences’s former head, John Jacobs, will be taking his place. According to Glenn, Erck stuck it out at Novavax to see the company’s shot win approval — and set the stage for a “successful exit.”

“What he’s done has been amazing,” Glenn said. “From being a limping along company to becoming a commercial entity with $2 billion in revenue in the first year, a product licensed around the world and manufacturing operations … an experienced team with commercialization, regulatory and medical affairs, etc. The new CEO will inherit a mature organization.”

Despite the pressures of maturing quickly into a commercial enterprise, Glenn said the company’s work in vaccines has helped keep the team rallied around its goals.

“People in vaccines want to have an impact — and you can’t beat vaccines for public impact,” he said.

The company’s experience will also undoubtedly help it nurture the other candidates in its pipeline, including vaccines for malaria, MERS, SARS and RSV — a virus experiencing a drug development dash of its own. But for this year at Novavax, COVID-19 will be at the forefront.

“COVID is still killing 3,000 people in the U.S. each week,” Glenn said. “So (our focus) has to be on giving customers what they want with COVID vaccine.”