The early October FDA authorization of Novavax’s updated COVID-19 vaccine marked a much-needed win for the company. But the regulatory success hasn’t quieted concerns that surround Novavax’s position in the competitive landscape, such as the pace of its rollout, the company’s financial fortunes and the lackluster COVID-19 vaccine market.

A win is still a win, though, according to Musaddiq Khan, vice president of digital clinical trials solutions in vaccines at clinical research software company Medable.

“Some industry leaders have said this (authorization) was critical for the company's financial success going forward, and yes, approval here was critical for Novavax as it's the only product they can market at the moment,” Khan said.

Novavax reported a profit in the second quarter but has significantly scaled back its sales outlook for the year, anticipating vaccine sales of between $960 million to $1.14 billion as the focus remains on cost-cutting. The company plans to release more details that shed light on its post-approval standing in the coming weeks.

“The company continues to make important progress against our goals, and you can expect to hear more about this during our Q3 earnings call,” Novavax officials said in an email to PharmaVoice.

A tried-and-true approach

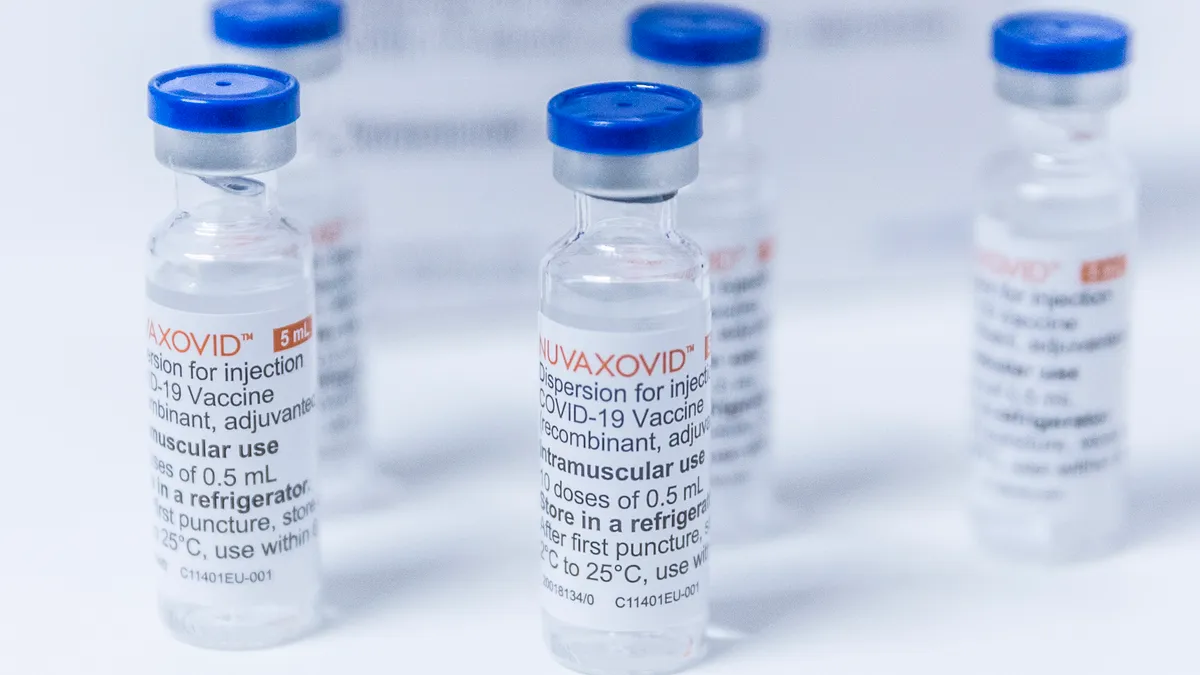

The approved Novavax shot is an updated version of its original formulation, modified to target the Omicron XBB.1.5 variant. Unlike mRNA shots from Moderna and Pfizer-BioNTech, the jab uses a more traditional protein-based model employed by other common vaccines, including those for hepatitis B and shingles. This makes Novavax’s shot an alternative to mRNA or those ineligible for certain shots due to allergies or other factors.

Novavax’s own market research showed that 25% to 30% of people prefer a protein-based vaccine, a spokesperson said.

The vaccine, like the updated mRNA shots, was formulated for the XBB.1.5 variant, which is no longer the predominant circulating strain — that distinction goes to EG.5, otherwise known as Eris. However, experts believe that vaccines targeting the Omicron variant will still be effective against the newer crop of infections.

“The addition of a new protein-based vaccine is a helpful tool in the armory against COVID-19, and we need to be prepared for what the future could hold,” Khan said.

A few years ago, an FDA nod for a COVID-19 vaccine meant a significant windfall would soon follow. Now, however, dampened enthusiasm for COVID-19 vaccines and treatments has struck companies across the board.

In mid-October, Pfizer, BioNTech, Moderna, and Novavax saw their stock prices drop after Pfizer scaled back a sales forecast by $9 billion for both its vaccine and COVID-19 treatment Paxlovid, citing softening interest in COVID-19 products. A recent poll found that less than half of adults (47%) plan to get an updated COVID-19 vaccine this fall, and 37% of previously vaccinated people said they will “probably” or “definitely” not opt to get the new one.

“There has been a slump in demand for Covid-19 vaccinations, but Novavax brings a differentiator with its protein-based vaccine, a technology advantage that could alleviate any lingering public concerns around mRNA vaccines,” Khan said.

The road ahead

The latest approval didn’t come easy for Novavax — the company lost 95% of its market value since early 2022 and announced a restructuring this spring as sales of the original vaccine lagged. To shore up its financial position, Novavax sold 7% of its shares to South Korea’s SK Bioscience to reduce liabilities to the company.

Today, Novavax remains an underdog, competing against more established competitors with deeper pockets. About 7.6 million updated mRNA shots went into arms this fall before the FDA signed off on Novavax’s shot. Furthermore, the company is still awaiting approval by European Union regulators, who delayed their decision in mid-October after requesting more information from the company.

It wasn’t always that way. The company was an early frontrunner in the race for a COVID-19 vaccine at the height of the pandemic but staggered to the finish line behind Pfizer-BioNTech and Moderna due to regulatory and manufacturing delays. The FDA didn't authorize Novavax’s first shot — also its first commercial product — until July 2022, and even then the go-ahead was fraught with restrictions.

The original shot was only available as a primary two-dose series, barring it from being mixed and matched with other vaccines, ruling it out as an option for anyone who had gotten an earlier shot from another manufacturer. The FDA later authorized it as a booster in adults 18 and older, but only if an mRNA shot wasn’t available or clinically appropriate.

This time, the authorization is less restrictive, offering more runway for Novavax. According to the FDA, people can receive one dose of the vaccine if they’re already vaccinated, or two doses if they aren’t.

While the Novavax vaccine appeals to those who can’t take or don’t want mRNA shots, it hasn’t demonstrated clear efficacy advantages to entice people to switch brands. One recent study found that the vaccine performed about the same as the mRNA shots, reducing overall COVID-19 infections by 31% and symptomatic infections by 50% in fully vaccinated people. It may produce fewer side effects but is still associated with increased risk for rare but serious side effects seen with the mRNA vaccines, such as instances of heart inflammation called myocarditis and pericarditis. However, there is some evidence that people who receive more than one vaccine formula could benefit from a boost in immunity.

“There is not enough data for a definitive conclusion, but initial research suggests that receiving a protein-based vaccine booster after an mRNA vaccine may provide the best immunity of all,” Khan said. Novavax also has a logistical advantage over the mRNA vaccines because it can be kept in a standard refrigerator for months and doesn’t need ultra-cold storage.

Ultimately, it remains to be seen how effectively the Novavax vaccine can attract converts and newcomers in the narrowing market space. Company officials hope their protein-based shot will put the company back on steady ground, because as weary as the public has become of the virus that causes COVID-19, experts say it’s here to stay.

The question now is, will the demand for this new option be enough to carry the underdog Novavax forward?