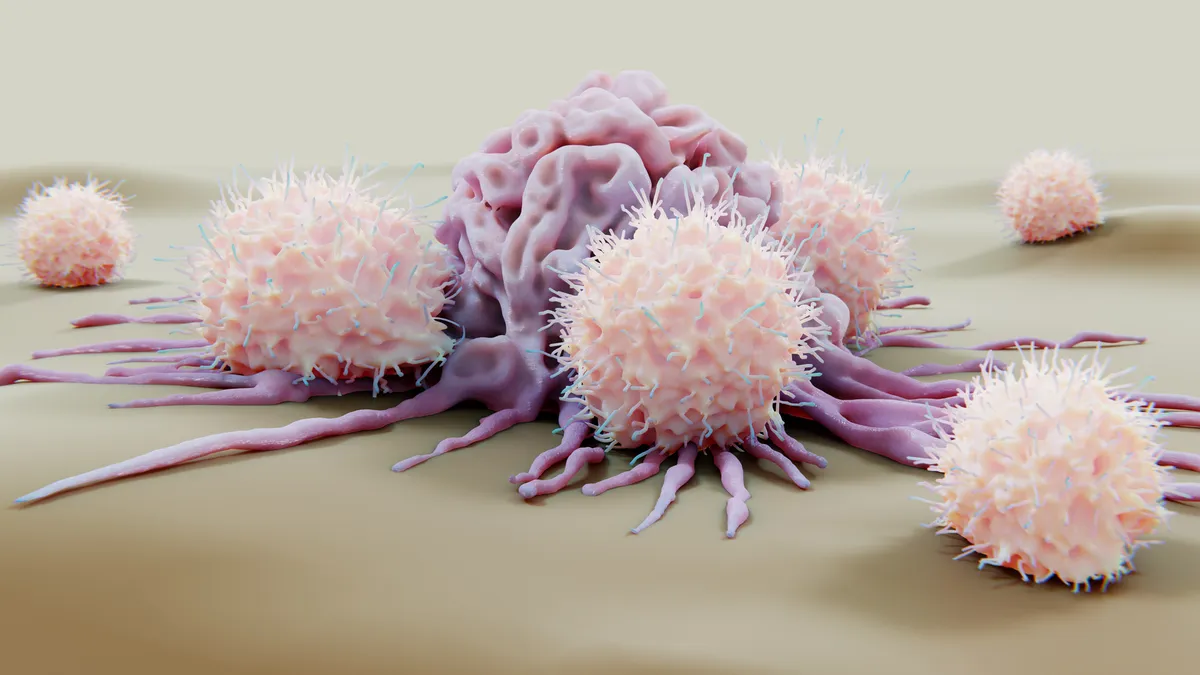

Natural killer cells continuously patrol the human body, swiftly eliminating viruses and cancer cells, like sharks in prey-laden waters. Several biotech companies are harnessing the power of these innate immune crusaders in oncology and autoimmune diseases, potentially positioning them as a strong competitor to CAR-T cell therapies.

Unlike CAR-T cells, NK cells don’t need genetic modification to recognize a specific threat — they act broadly without customization. However, some NK companies, such as Fate Therapeutics and Cytovia Therapeutics, enhance NK cells with chimeric antigen receptors to increase precision and efficacy.

NK cell options tend to produce fewer serious side effects, making them particularly appealing in the autoimmune space, which has less risk tolerance than oncology.

“The advantage of NK cells over a T-cell approach is that NK cells can kill the target cell without causing that runaway cytokine release syndrome,” said Dr. Fred Aslan, president and CEO of Artiva Biotherapeutics. In addition to potential safety advantages, NK cell therapies could disrupt the market by offering a less costly off-the-shelf option that speeds patient access.

A change in direction

Artiva began testing its lead NK cell therapy, AlloNK, in cancer but shifted much of its attention to autoimmune applications following the success of a German CAR-T cell study that showed the technology’s potential to treat serious autoimmune diseases such as lupus. Aslan said NK cells could have similar abilities, and the appeal of a larger market and earlier-stage competition helped drive the pivot.

Artiva has raised more than $200 million in private funding to back its efforts, in addition to a $167 million IPO in July, reflecting the rising interest in the research area. But the company faces considerable competition from companies such as Dragonfly Therapeutics, which has collaborations with Merck & Co., AbbVie, Gilead Sciences, Bristol Myers Squibb and more.

“Our NK cell therapy could really move the needle from a payer perspective and an access perspective."

Dr. Fred Aslan

CEO, president, Artiva Biotherapeutics

AlloNK works alongside monoclonal antibodies, such as rituximab or obinutuzumab, in combinations chosen for each target. In patients with cancer or autoimmune disease, NK cells are often diminished or impaired.

“Although a monoclonal antibody can be effective, it may not have the opportunity to work as well because of poor NK cell function,” Aslan said. “So our basic hypothesis is that by giving large numbers of exogenous NK cells together with monoclonals, we get to the cell we want to kill, and we do it much more effectively, beyond what a monoclonal could do by itself.”

Artiva derives NK cells from umbilical cord blood.

“From one umbilical cord unit, we can make thousands of vials, each with a billion cells,” Aslan said. “Our dose today in the clinic is three billion cells per patient, so that means one umbilical cord could treat over 1,000 patients.”

The projected cost of vial is less than $1,000, and treating a patient requires roughly three weekly outpatient infusions — ringing up a substantially lower cost compared with CAR-T, which typically costs hundreds of thousands of dollars, Aslan said.

“Our NK cell therapy could really move the needle from a payer perspective and an access perspective,” he said.

Artiva established an early milestone in autoimmunity as the first NK cell therapy to gain IND approval. AlloNK also received FDA fast-track designation to treat lupus nephritis and relapsed/refractory non-Hodgkin lymphoma of B-cell origin. The company dosed its first lupus patient in April.

Artiva is also testing a basket set of indications, including rheumatoid arthritis, pemphigus vulgaris and vasculitis. The company is still evaluating AlloNK’s potential in non-Hodgkin lymphoma and relapsed/refractory CD30-positive lymphomas, Aslan said.

“There will be some very compelling treatments coming out of this field and there will be room for a lot of different players here,” Aslan said.