As the corporate world invests more in digital spaces and less in physical offices, biotechs still need labs and research facilities. That trend couldn’t be more clearly demonstrated than by Merck & Co.’s sale earlier this year of its huge Kenilworth, New Jersey, headquarters to a real estate business determined to fill the space with biotech tenants.

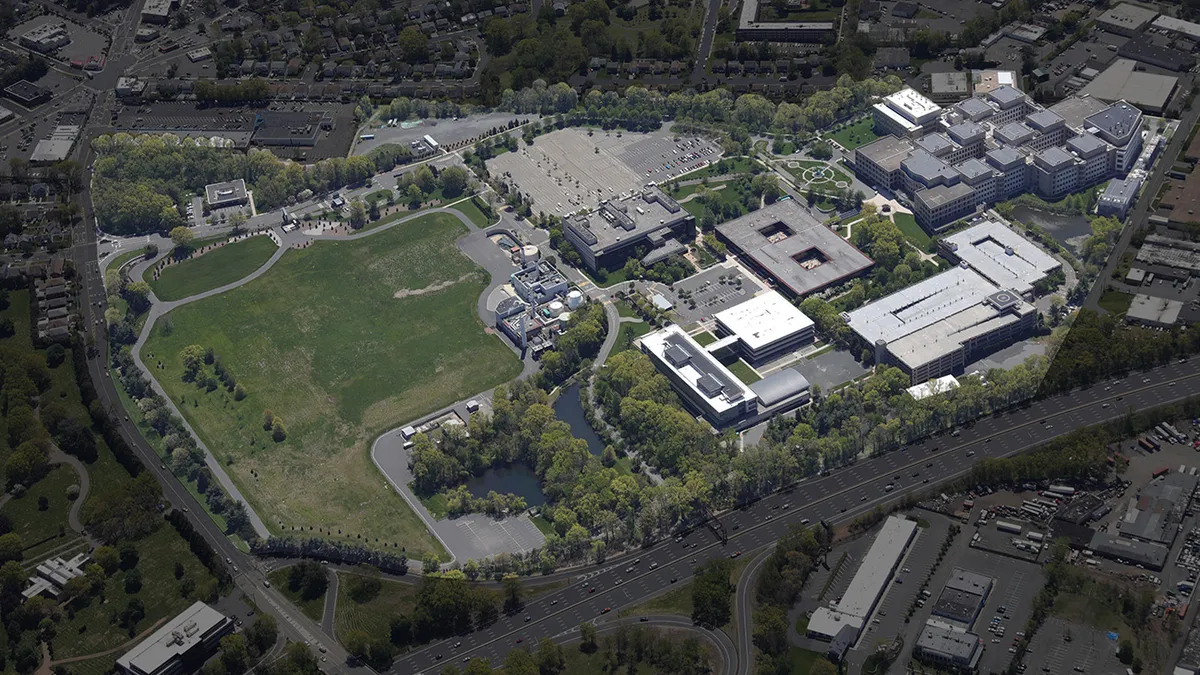

Onyx Equities bought the pharma giant’s former 108-acre spot in February to establish the Northeast Science and Technology Center, which it announced at the Biotechnology Industry Organization’s (BIO) conference in June, and plans to market the site to biopharmas in need of lab space. Meanwhile, Merck in 2022 moved its global headquarters to a larger site in Rahway, New Jersey.

New Jersey Gov. Phil Murphy said in a report that the transaction was a win-win for the state, and Onyx co-founder and managing partner John Saraceno told PharmaVoice that the proposed hub is gaining traction in the industry, along with Onyx itself, which has also invested in other life science projects in the state, including J&J’s Kenvue global headquarters.

Demand for lab and R&D space boomed in the years following the pandemic but has slowed in 2023, according to a report from commercial real estate services and investment firm CBRE Group. Still, uncertainties remain due in part to economic conditions, and biotechs will need to navigate those waters with care.

Here, we spoke to Saraceno about how the purchase came about, why biotech is the logical next step for a facility like this and the importance of creating hubs that serve the industry’s specific needs.

This interview has been edited for brevity and style.

PHARMAVOICE: Can you tell me about how the purchase of Merck’s campus came about?

JOHN SARACENO: We started in 2015 to look a little more intently at the life sciences arena — we had historically been office, industrial, retail mostly in New York, New Jersey and Pennsylvania. New Jersey has been a great pharma state but really (more) in terms of corporate headquarters and not as much as an incubator in the venture capital and private equity world. And with the trajectory of giving up office campuses, the questions is how to retenant them, and we saw biotech and life sciences as a way to do it.

First we looked at another big campus in Morristown, New Jersey — that opportunity fell by the wayside, but it was a tremendous educational process for us on how the conversion works, where it works well, infrastructure costs. It got us into the game a little bit, and then we bought an old Celgene facility in southern New Jersey, but again, the opportunity to make it an incubator facility fell by the wayside. So, when this opportunity came about, it was great because it wasn’t a conversion. In New Jersey, Pfizer and Merck and J&J and BMS and Novartis have all given up office space, but they haven’t given up a lot of their research facilities. This is the first time we’ve been able to take a purpose-built modern life science facility and afford an opportunity to other companies in the arena to move in almost immediately.

What would biotechs be looking for at this campus?

The facility is 2 million square feet, and a million and a half of that is historically just R&D space. And then you have Merck’s most recently built 200,000-square-foot biomanufacturing, which was the highest deliverable they’ve ever done in the U.S. So it runs the gamut and it gives us great flexibility to attract a whole array. Particularly with the one purpose-built building on site, we’ve had a tremendous amount of interest.

What are the unique traits of the life science industry that you might not have expected?

What I didn’t expect was that, as much as people are willing to go around the country and take incentives on a state-by-state basis, the intellectual capital that is necessary in pharma and life sciences is not so willing to move around. Employees with a highly trained scientific background are less apt to pick up and move, in my opinion — they’re not as easily pushed around by corporate America.

What are some changes in the industry over time that make this a good investment on your part?

Merck brought a lot of power to the site. Bringing power to the site, and making it clean power, is tough, and the fact that it’s already there is beneficial for us. Because if you have to go get it today, it would be that much more difficult. That conversation is usually the second or third one that comes up, so having it was a big help. And that part of the conversation doesn’t change over time because clean power only becomes more relevant.

Why pick New Jersey as a biotech hub?

Again, it’s about the people. We have a great facility that has been in corporate ownership for seven years and it’s never been owned by a developer. And having that infrastructure is differentiating because it’s never been available in the state of New Jersey. And then being proximate to New York — five miles from the airport and 10 miles from the Lincoln Tunnel — is important. Proximity to people matters. When a company is looking for a location in the mid-Atlantic or in New England, I think we will be mentioned, particularly if you need size and scale. And you’re going to find the cost is materially better than somewhere like Cambridge, (Massachusetts).

How do you work with both the state of New Jersey and the industry as collaborators?

They’re teaching us as much as we’re teaching them. The state agencies trying to generate jobs have a much more scientific perspective, and so we work hand in hand to look ahead at what the needs will be down the road. Obsolescence is yesterday, not five years ago. The challenge in this industry is being able to see out five years or 10 years, because the infrastructure and the investment is so significant. You may think you have the latest widget and you don’t. From the scientific side, we’re constantly listening to that conversation.