Johnson & Johnson CEO Joaquin Duato said “2023 was a remarkable year” for the company on a call with investors to discuss quarterly and full-year earnings. But the healthcare giant also faces difficulties ahead, including biosimilars of blockbuster immune treatment Stelara entering the market and a hefty $700 million settlement over claims the company’s former talc product caused cancer.

As far as 2023 earnings, J&J narrowly beat Wall Street’s expectations overall with $85.2 billion in revenue but saw pharma sales grow a sizable 9.5% in the fourth quarter compared to the year before. Cancer treatments and immunology meds like Stelara made up the bulk of that revenue.

Here are some takeaways from executives on the J&J earnings that offer clarity on where the company is headed and the strategies they’re employing along the way. As one of the largest pharma companies in the world and often one of the first in the sector to report earnings each quarter, J&J is often considered a sort of bellwether for the industry, signaling larger trends to come.

“We expect innovative medicine sales growth to be slightly stronger in the first half of the year compared to the second half, given the anticipated entry of Stelara biosimilars in Europe towards the middle of the year. This headwind will be partially offset by continued uptake from our recently launched products.”

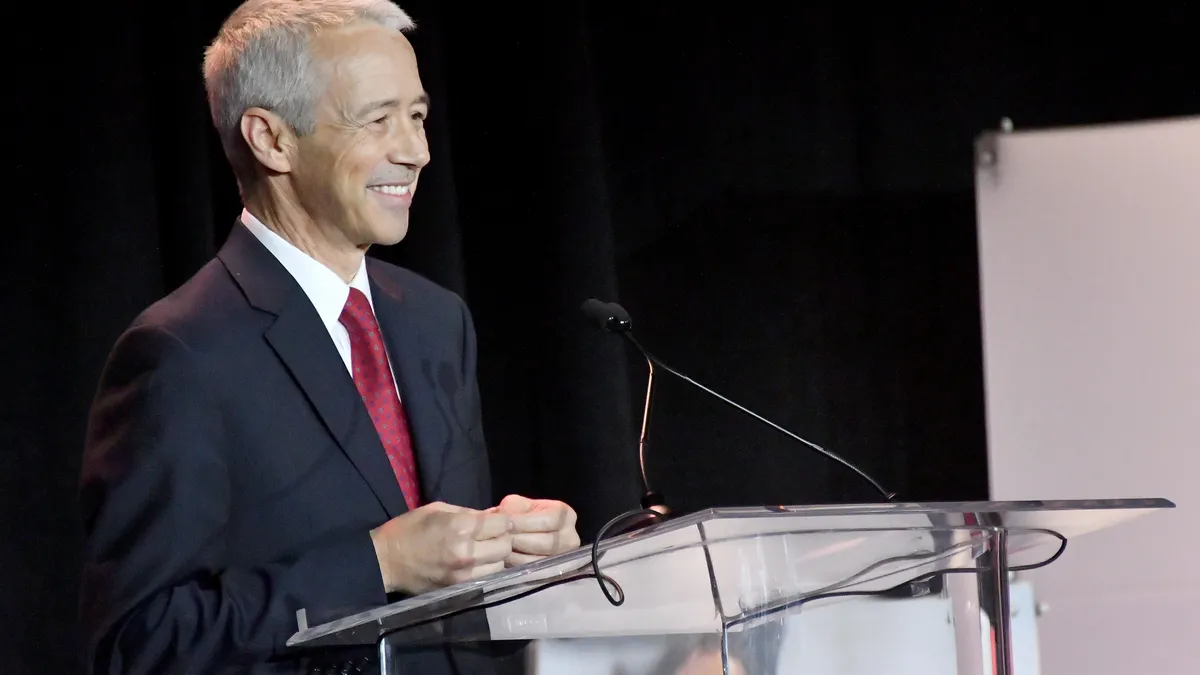

Joaquin Duato

CEO, J&J

With a key patent expiration last year, the psoriasis drug Stelara is expected to begin losing revenue as biosimilars enter the European market this year as designated by deals that J&J made with the competitors to hold off for another year. Because Stelara is such a cash cow for J&J with more than $10 billion in sales last year — a decent portion of the company’s total $54.8 billion in pharma sales — the patent cliff represents a significant drop in years to come.

But J&J has a slate of medicines beginning to pick up the slack, including the multiple myeloma drug Darzalex, newer treatments like the CAR-T cell therapy Carvykti (partnered with Legend Biotech) and other multiple myeloma drugs Tecvayli and Talvey. J&J spun off its consumer health unit Kenvue in 2023 and is now a two-pronged drug and device maker. But the transaction, via Kenvue's IPO and debt offering, generated more than $13 billion for J&J.

“Just last year, we completed … more than 50 deals — the thing is that the headlines are only made by the ones that are M&A, so we've done multiple deals in our pharmaceutical side in order to be able to enhance our existing portfolio.”

Joaquin Duato

CEO, J&J

J&J’s biggest deal of 2023 was not, in fact, in the pharmaceutical arena but rather in the shape of a $16.6 billion acquisition of med tech company Abiomed completed near the end of the year. That doesn’t mean the dealmaking has been quiet on the pharma side — but the kinds of partnerships and collaborations just don’t command the same kind of attention as a multibillion-dollar deal, Duato said.

The CEO said the strategy on the pharma side is to “find more opportunities to create value at an earlier stage,” focusing on building scientific expertise in key areas. The company’s partnership with China’s Legend Biotech to develop Carvykti is now paying off as one of the rising stars of J&J’s portfolio.

When it comes to M&A, J&J’s preference is “in areas in which we have internal capabilities and know-how,” Duato said, citing the $2 billion purchase of antibody-drug conjugate specialist Ambrx at the beginning of this year.

“We maintain the healthy balance sheet and robust credit rating underscoring the strength of Johnson and Johnson's financial position, which enables us to strategically invest and deploy capital to unlock value.”

Joseph Wolk

Executive vice president, CFO, J&J

J&J invested more than $15 billion in R&D, which amounts to almost 18% of sales — executive vice president and CFO Joseph Wolk said that makes the company “one of the top investors in R&D across all industries.” On top of that, J&J committed more than $3 billion to dealmaking in the last 12 months, Wolk said, which includes outright acquisitions and smaller partnerships.

Looking forward, J&J expects operational sales growth of between 5% and 6% in 2024 to as much as $89 billion across both the pharma and med tech arms.

“In innovative medicine, we expect 2024 to deliver a 13th consecutive year of above-market growth driven by market share gains from key brands such as Darzalex, Tremfya and Erleada, as well as continued adoption of recently launched newer products such as Carvykti, Tecvayli, Talvey and Spravato,” Wolk said.