The HHS isn’t wasting any time in implementing the drug pricing reforms laid out in the Biden administration’s Inflation Reduction Act (IRA) passed by Congress and signed into law this summer.

This month, the Centers for Medicare & Medicaid Services (CMS) carried out one of the first provisions of the law by temporarily increasing the add-on payment under Medicare Part B for certain biosimilars with an average sales price less than that of the equivalent biologic. The measure aims to incentivize the development of biosimilars and is among the first of the IRA drug provisions to go into effect.

Other reforms are likely to follow at a rapid clip. In a statement, CMS Administrator Chiquita Brooks-LaSure said the agency is “swiftly implementing” the IRA, including a major measure requiring Medicare to negotiate the prices for an increasing number of drugs per year. The agency has less than a year to iron out the details of the negotiations, as it is required to publish its initial list of the first 10 drugs subject to the policy by September 2023.

Despite this tight turnaround time, Ryan Urgo, managing director of health policy at Avalere consulting firm, warns drug manufacturers not to expect any holdups from the agency.

“Many of the provisions within the IRA are pretty prescriptive in terms of the dates and the specific aspects that have to occur by a certain time so I don't think you're going to see wholesale delays,” he said.

As drugmakers brace for the pending negotiations, Urgo laid out what they can expect from the CMS over the coming months and even years, major factors that could impact the policy, and best practices for interacting with regulators during these times.

Policy is personnel

On Oct. 8, CMS created a new division — the Medicare Drug Rebate and Negotiations Group — to oversee the drug pricing negotiation policy outlined in the IRA.

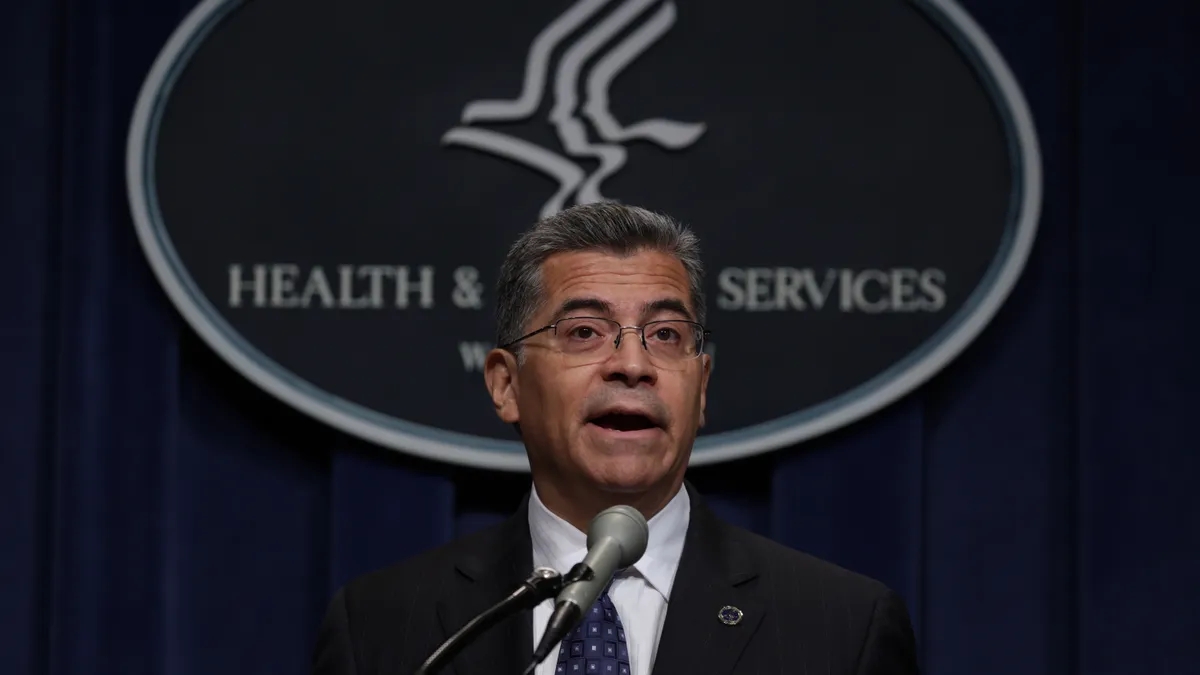

“The scope and complexity of these new programs, and the deadlines for implementation, require that a new, dedicated organization be established to ensure that CMS is able to implement these programs successfully and on time,” the HHS Secretary Xavier Becerra said in a notice announcing the new division.

And, according to reporting from STAT, the agency plans to hire 95 full-time employees to staff the group with economists, analysts, pharmacists, policy advisers, data officials and contracting officers.

The people it hires to fill these positions will have an enormous impact on how the details of the policies in the IRA are actually implemented, Urgo said.

“As HHS is staffing up for the negotiation policy, it would not be uncommon for them to accept meeting requests from manufacturers and plans that may have input on key considerations related to the implementation of IRA policies,” he said, but noted that it is “hard to say” if meetings could impact staffing decisions.

However, once the division is staffed up, industry will have plenty of opportunity to engage, he said.

Fluid rulemaking

Unlike with most new policies, the HHS is not required under the IRA to go through a formal rulemaking process with a traditional notice and comment period before enacting the law.

This could make it more challenging for industry stakeholders to influence the policy, as it places greater pressure on companies to engage with the agency, but Urgo says organizations will still have plenty of chances to get their thoughts heard.

“There's a real opportunity for proactive engagement,” he said. “I think that manufacturers and other stakeholders should not despair over the lack of a formal rulemaking requirement. They should be availing themselves of every opportunity to understand the implications of these policies.”

Urgo also noted that while no formal rulemaking is required, the agency is likely to initiate traditional processes for “some of the more ambiguous parts” of the law.

“For example, the negotiation provision leaves a lot of unanswered questions. I suspect there will be a fair amount of input that they'll need to seek, if not in this first run-up to standing up of the policy, at least in the (later) years there might be a more traditional notice and comment process,” he said.

"Manufacturers and other stakeholders should not despair over the lack of a formal rulemaking requirement."

Ryan Urgo

Managing director of health policy, Avalere

Ready the evidence

One of the more ambiguous parts of the IRA’s drug reform policy revolves around how the HHS will look at the data submitted by drug manufacturers to defend the prices of their products. The law draws a line on how high the price of a drug can go, known as the maximum fair price, but does not say anything about a floor for how low the HHS can negotiate the price down.

“Given that there's such a wide range of where that could end up creates a tremendous amount of uncertainty for manufacturers,” Urgo said. “The extent to which they are compiling data that demonstrates the economic value of their product, the better position they will be to stave off stronger efforts by (the) HHS to negotiate a price.”

This means companies with medications that could end up on the negotiation list come September should begin preparing evidence that displays the drugs' ability to lower medical costs in the healthcare system or that shows its strong utility and positive impact on health outcomes.

“I'm not going to say that (the) HHS is going to look at the negotiation process through the lens of a value assessment framework, but I think manufacturers should be at least preparing along those lines,” Urgo said.

After the list is published, companies with drugs under negotiation will have until 2026 to discuss the evidence and work out a price with the HHS.