Many biotech companies have their roots in academia, from Exscientia, the AI-based University of Dundee spinoff which last year scored a $5.2 billion deal with Sanofi, to MiroBio an Oxford University spinoff that Gilead Sciences acquired last year for $405 million.

Yet there’s no easy-to-find blueprint for academics and scientists who want to make the leap from a university to the startup world.

“It’s still a fairly less usual path to go out and start your own company versus to build a lab in academia,” said Kristen Fortney, CEO and co-founder of the clinical-stage biotech BioAge Labs. “By and large, there are no good books you can read (that say) follow these steps.”

A few training programs exist, like The Collaborative for Technology Entrepreneurship and Commercialization at Rutgers and the Kauffman Foundation’s Entrepreneurship Scholars. Still, the lack of more resources could be contributing to the fairly low rates of success among university-born biotechs.

According to an analysis released in 2020, of the top 50 patent-producing universities that spawned life sciences startups between 1980 and 2013, just 13% were eventually acquired and 10% conducted an IPO.

“You need to handle (everything) from science, to business, to pitching to investors, to fundraising.”

Priyanka Dutta-Passecker

CEO, co-founder, Healiva

Part of the challenge is that it takes more than a great idea and solid science for a biotech to thrive — business strategy, fundraising skills and leadership savvy can all come into play.

“You need to handle (everything) from science, to business, to pitching to investors, to fundraising,” said Priyanka Dutta-Passecker, CEO and co-founder of Healiva.

And what about the soft skills leaders learn by trial and error? We asked several academics-turned-executives what they learned about that pivot point between academia and entrepreneurship to find out.

Get advice from leaders who are one step ahead of you

Having mentors who’ve been in the industry for a long time is valuable, but so is talking with people who are only one step ahead of you in the launch process, Fortney said. The industry evolves so rapidly — from fundraising to financial software — that advice about an experience that happened as little as five years ago may not be as applicable now.

“Ideally, you have a few people who are one step ahead of you…their experience is still recent enough to be relevant to you,” she said. “So that they've been through exactly what you've been through.”

Reach outside of your network

“You really can reach out to anyone,” Fortney said. Although she started by working within her network at Stanford University when she co-founded BioAge, Fortney now tries to find out “who in the world knows the most” about a particular topic and reaches out to those people for a conversation.

“They won't always respond. But a lot of the time they do,” she said. Fortney even found one of the company’s best advisors “without actually having any connection initially, but then sort of building from there.

“There are a lot of smart people that can be helpful that are going to be interested in helping you,” she said.

Assemble advisors early

Fortney “didn’t appreciate” how helpful it would be to bring pharma pros into the fold when BioAge was in the early stages of its inception.

“I thought, ‘We’re working on targets now,’” she said. “So we don’t need pharma people.”

Although they had really great advisors early on, finding ones who’ve been “on the ground” in the drug discovery and approval process has turned out to be critical.

“It's actually really helpful to have that expertise early,” she said. “That’s honestly a really good thing to have from day one.”

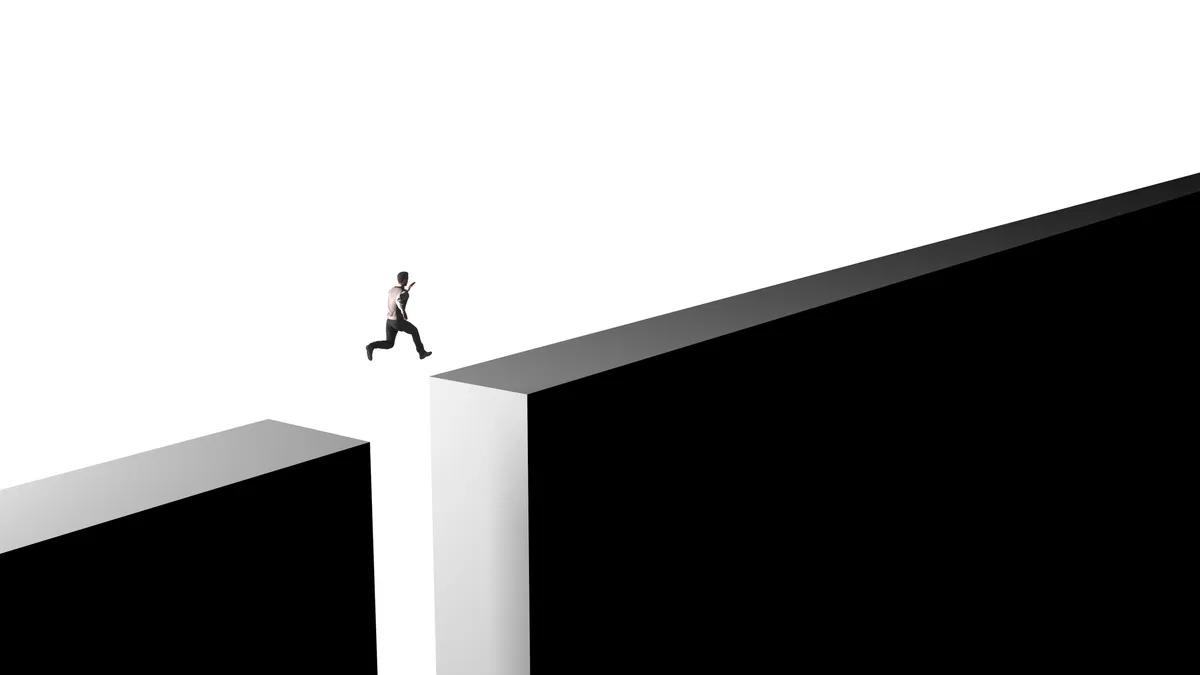

Build your tolerance for risk

Risk aversion prevents many academics from bringing their ideas to market.

“There are a lot more scientists out there … who have ideas that could lead to really exciting companies who may just be afraid to leave academia,” Dr. Amit Etkin, who left a position as a tenured professor at Stanford University to become the founder and CEO of Alto Neuroscience, said in an interview with PharmaVoice last year.

Tasuku Kitadam, co-founder, president, and head of R&D at Strand Therapeutics echoed that sentiment.

“I see a lot of extremely smart, talented people that might be a little bit more conservative with the way they think,” he told PharmaVoice last year. “I think the difference between an entrepreneur and people that are not entrepreneurs is how risk averse you are, and if you have a high-risk aversion, I think you end up not doing it.”