Welcome to today’s Biotech Spotlight, a series featuring companies creating breakthrough technologies and products. Today, we’re looking at Candel Therapeutics, a company that recently welcomed a phase 3 win in prostate cancer with a viral immunotherapy approach following a restructuring of the company earlier last year.

This time last year, Candel Therapeutics was burning at both ends. Now, despite tough decisions, the cancer immunotherapy company is celebrating a major win.

For a clinical-stage biotech, navigating the treacherous market of the last few years is a testament to perseverance and resilience, as well as a belief in the fundamental science behind that work. Candel emerged from that harrowing landscape — through layoffs and other sacrifices — with late-stage clinical data that holds promise in the tricky area of prostate cancer, shedding light on a new approach in immuno-oncology.

Candel’s CEO, Dr. Paul Peter Tak, former chief immunology officer and global head of development at GSK, cut half of the company’s workforce near the end of 2023 to make room for clinical costs, while also shedding manufacturing expenses to stretch its cash runway into the end of last year.

“It’s a very painful decision to let great people go — but I think that was the right decision,” Tak said. “From a business perspective, we were in survival mode.”

The strategy kept the company going in the runup to a December readout of positive phase 3 results for its lead viral immunotherapy candidate CAN-2409 in prostate cancer, reaching the primary endpoint of disease-free survival. The prospective drug is an off-the-shelf virus that delivers a type of herpes simplex gene to induce an immune response along with radiation therapy.

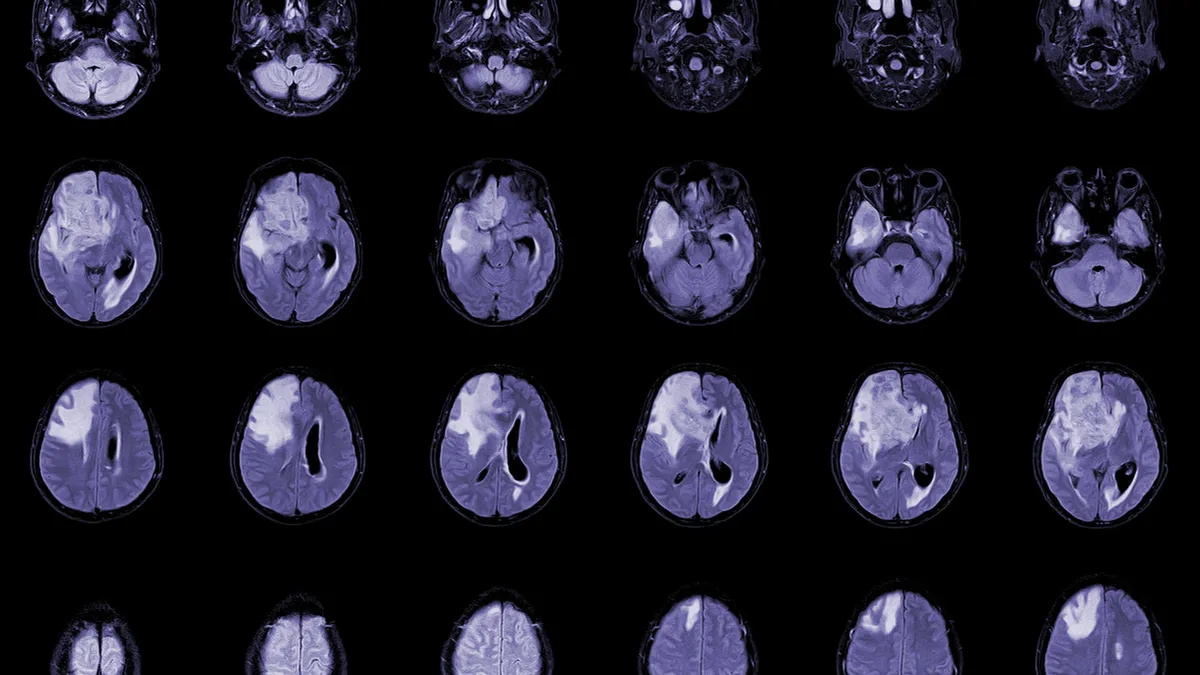

Because Candel had a special protocol assessment agreement with the FDA, the prostate trial could serve as registrational for regulatory approval, and Tak said the company is aiming for a fourth-quarter 2026 submission to the agency. The biotech is also using similar therapeutic approaches for earlier-stage candidates in diseases like non-small cell lung cancer, pancreatic cancer and high-grade glioma.

"Viruses are very good at delivering genes to cells — that’s what they do for a living."

Dr. Paul Peter Tak

CEO, Candel Therapeutics

Candel saw its stock soar 200% on news of the trial success and shortly thereafter closed a public offering worth $92 million. The share price is almost 500% higher than it was a year ago, when the company was almost delisted from the Nasdaq stock exchange, Tak said.

Here, Tak discusses Candel’s unique approach to immunotherapy, CAN-2409’s runaway success in the clinic that could land it a coveted spot in the treatment landscape, other candidates in its immuno-oncology pipeline and, of course, the hand-wringing process of making cuts to reprioritize that science.

This interview has been edited for brevity and style.

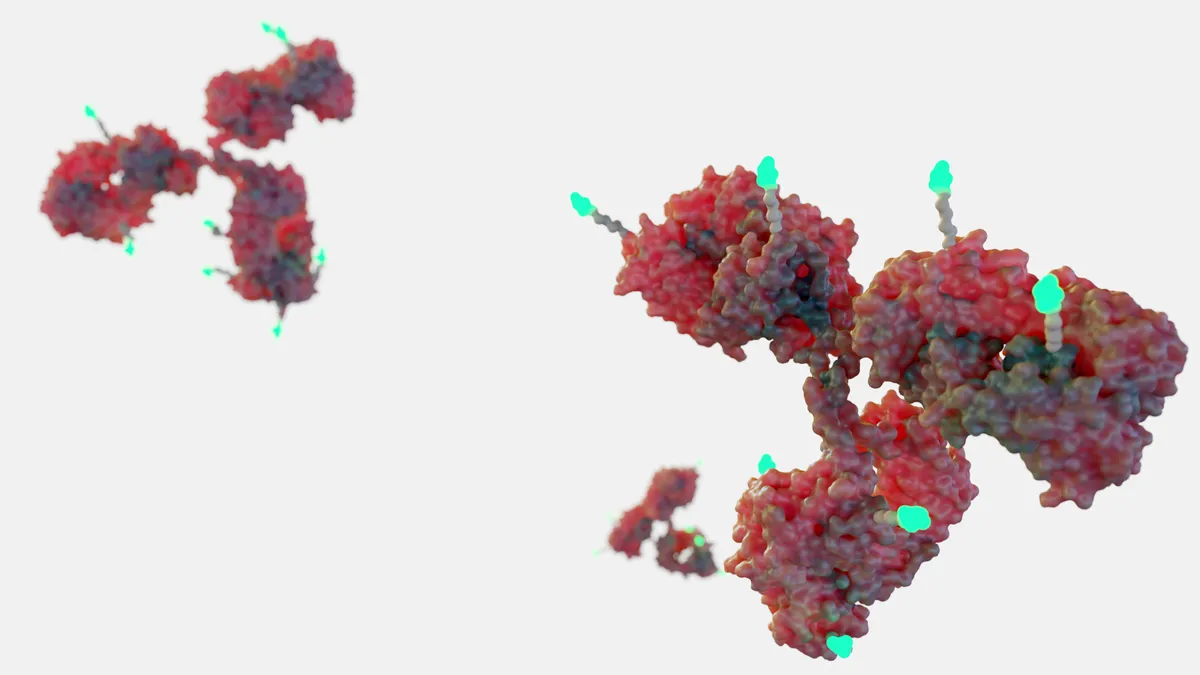

PHARMAVOICE: Using viruses to stimulate an immune response against a tumor, how does your platform stand apart from others in the immuno-oncology field?

DR. PAUL PETER TAK: It’s actually completely unique, which also leads to misunderstanding. CAN-2409 is a platform in itself, a pipeline in a product that we call a viral immunotherapy. Often people think it’s an oncolytic virus, but it’s not — it’s an approach combining CAN-2409 delivered into a tumor with a small molecule tablet called valocyclovir [often used to treat herpes virus infections] that’s taken for two weeks. Together that leads to in situ vaccination against the patient’s own tumor as well as uninjected metastases. It’s a vaccination approach against the whole variety of cancer antigens that are released in the tumor microenvironment.

The virus is used basically for in vivo gene therapy. Viruses are very good at delivering genes to cells — that’s what they do for a living. Similar to what’s done in gene therapy, we deliver the herpes simplex virus thymidine kinase gene that leads to expression in the tumor. So then, when you give valocyclovir, it activates for a very strong inflammatory signal to the tumor microenvironment. In other words, you create the optimal conditions to vaccinate the patient against the patient’s own variety of cancer antigens. That leads to an immune cell response that’s largely mediated by CD8-positive tumor infiltrating lymphocytes that circulate throughout the body, and they will ultimately be the medicine against the tumor.

A huge wave of checkpoint inhibitors made a really big difference in oncology in the last decade. What does the next wave look like?

We are actually talking about the next wave now. When you think about the immune checkpoint inhibitors, which has been a major breakthrough for about a third of patients, you see durable responses and even cures. It’s a paradigm shift. That’s why the Nobel Prize was awarded to, among others, Jim Allison, who is on our research advisory board. But this leads to a non-specific activation of the immune response, and it doesn’t work in all patients.

CAN-2409 is an off-the-shelf product that leads to an individualized response. This is an example of a cutting-edge new frontier in immunotherapy. We also see the success of some other companies in different indications with slightly different approaches, like Replimune, CG Oncology and J&J, which moved into this field quite significantly with their viral immunotherapy. In fact we’re working with [leading immunologist] Dr. Carl June to develop viral immunotherapies that may help bring his CAR-T cells into solid tumors like pancreatic cancer so we can convert non-responders to immune checkpoint inhibitors into responders, as we’ve shown in non-small cell lung cancer. This is one example of the new frontier in immunotherapy.

Tell me your perspective on the recent results for CAN-2409 and the primary endpoint of disease-free survival.

This is a unique study because everybody else is focused on late-stage disease, but there’s a big unmet need in early localized disease. It’s not necessary to prolong life in terms of overall survival. Prostate cancer is the second most common cause of cancer after all the skin cancers grouped together, and it’s not a problem that has been solved because the currently available treatments are associated with significant side effects and complications. So we wanted to increase the probability that patients would be disease-free over time so they would not need additional procedures associated with loss of quality of life. We wanted to show that there was no evidence whatsoever of any cancer cells in these patients — it was a very high hurdle, but we achieved it quite convincingly. This is a curative intent focusing on disease-free survival, which means there will be an immediate benefit in terms of quality of life because the patients don’t need other treatments.

Can you talk about what went into the decision to restructure the company earlier last year with cuts to both the workforce and manufacturing?

Let’s start with the priorities. We applied filters to the program, including the scientific rationale, the medical unmet need, the feasibility, the regulatory pathway and the market opportunity. We only focused on opportunities that are potential blockbusters. So you need to make choices — we’ve always tried to keep the company very lean and work in a very cost-effective way. We did five clinical trials last year, and at some point we needed to make a decision about raising money at potentially unfavorable terms in a very difficult biotech market last year, one of the most difficult times in biotech history. We wanted to get in the most cost-effective way to the value-creating inflection points, and then you can raise money based on much more favorable terms.

The phase 3 probability of success is, on average, about 35%. I did not feel comfortable making huge investments in manufacturing at risk before I had seen the data. I would have made the same decision when I was at GSK. We’ve seen many other companies that fell over because they made big investments in manufacturing that were premature. The phase 3 program could have been negative, and then we would have spent tens of millions of dollars that we could have spent on other programs. I try to be very systematic about our decision trees. Now that it’s positive, we want to go as fast as possible, but manufacturing always takes time. If we had invested a year ago at risk, we would be further ahead, but that’s a decision we made with our eyes wide open, and I don’t regret it at all.

What does your cash runway look like now?

We are in a very good position at the moment with the money we’ve raised and other catalysts coming up even in this quarter. We expect overall survival data and biomarker data in non-small cell lung cancer and pancreatic cancer, and we will read out of the phase 1b clinical trial in high-grade glioma later this year — and that gives us additional opportunities to raise money. We’ve not yet finalized our strategy with the board with all these events happening just a few weeks ago. At this moment we are in a very good spot.

Are you looking forward to a busy J.P. Morgan healthcare conference next week with this data in hand? That could put some deals on the table.

I’ve always said that we will be open to the right strategic opportunity, but at the same time, we are not desperate and we will only do a deal that’s good for patients and good for all stakeholders. Obviously, there’s a lot of interest in the company, and we will continue to engage, but strategically, I’m not interested in building a huge commercial organization myself and thereby cannibalizing the unique R&D capability we created. Having been a Big Pharma leader myself, I know that pharma companies are really good at getting this to as many patients as possible and extracting the value, but we will take our time to get to the right strategic deal and keep all options open, including going all the way ourselves.