R&D spending in the biotechnology sector almost doubled in the five years leading up to 2022 — and while that shows promising growth for the future of the industry, it also demonstrates an opportunity for savings that could help biotechs improve their bottom line.

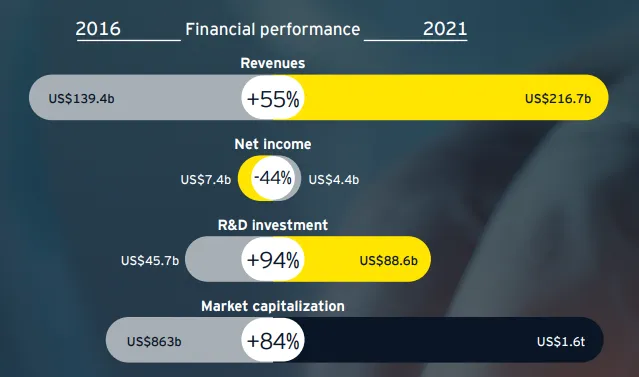

From 2016 to 2021, biotech revenues grew 55% and their market capitalization shot up 84% — but despite high sales and investor funding, net income fell 44% in those five years, according to a "Beyond Borders" report from accounting firm EY.

As R&D investment skyrocketed to $88.6 billion in 2021 from just $45.7 billion in 2016, and net income has taken a hit, service providers in the data and clinical trials space have been using new technology and strategies to help biotechs make the same amount of progress faster and at a lower cost.

Here are some of the changes that are helping biotech companies use data and clinical technologies to improve their overhead.

Growing the database

Access to data is crucial for clinical research, and many biotechs have limited employee power to make the most out of what’s available, Verana Health CEO Sujay Jadhav says.

"Most large pharmas have big data science teams — armies of people to curate data — and biotech folks don't have that," Jadhav says. Verana provides access to huge data sources comprising electronic health records that can give biotechs the information they need in the areas of ophthalmology, urology and neurology.

Embracing real-world evidence

Biotech companies are using real-world evidence to understand their own market, says Parexel's vice president of real-world evidence strategy, Matthew Gordon. He says that while RWE was initially used in a more commercial setting, companies are increasingly using it to bolster their clinical understanding.

"I think in the mid-2000s, real-world evidence evolved from being just commercially driven to actually being able to support the collection of safety data," Gordon says. "The shift was seeing that we can actually use this data more effectively throughout the life cycle."

Trials, decentralized

A study from clinical research organization Medable and Tufts University found that financial return from decentralized trials vastly outperforms that from traditional brick-and-mortar trials. Returns on investment were about five times higher in phase 2 and 13 times higher in phase 3, according to the study, which found savings from reduced cycle times, improved patient screenings and enrollment, and fewer protocol amendments over the life of the trial, Medable's chief scientific officer, Pam Tenearts, says.

"With decentralized trials, you're spending a little bit more money up front than you're used to with brick-and-mortar trials because you're buying technology," Tenearts says. "What we see with DCTs is that you're making money earlier because you're improving cycle times and enrollment by about 5% or 10% … and the numbers are exponential from there."

Direct from the patient

Electronic clinical outcome assessments — known as eCOAs — are one way companies performing clinical trials can get better connected to patient data, IQVIA's eCOA manager Melissa Mooney says. These assessments allow patients to report their personal experiences with treatments, capturing data that has not always been available to drugmakers.

"eCOA in the industry really plays an important role in being able to easily capture the patient voice," Mooney says. "We use technical solutions to administer assessments that are meant to gather from the patient what their disease symptoms are, the effects of their treatment, how their disease and their treatment impacts their physical function and just the overall impact on their quality of life."

Buy into the change

A major challenge for biotech companies in the R&D space is simply making the transition to more data-oriented operations, says Katrina Rice, eClinical Solutions' chief delivery officer in data services, which partners with companies to streamline their information management.

"What I think some of our clients are struggling with is overall change management [and] changing the way they do business. In many organizations, as much as you think it would be easy, that's not easy to do," Rice says. "Because you need to get people to buy into the change, and for them to realize a benefit and value to them."