Welcome to today’s Biotech Spotlight, a series featuring companies creating breakthrough technologies and products. Today, we’re looking at Fractyl Health, a company that recently announced a significant pivot that could allow it to cash in on the GLP-1 boom — and beyond.

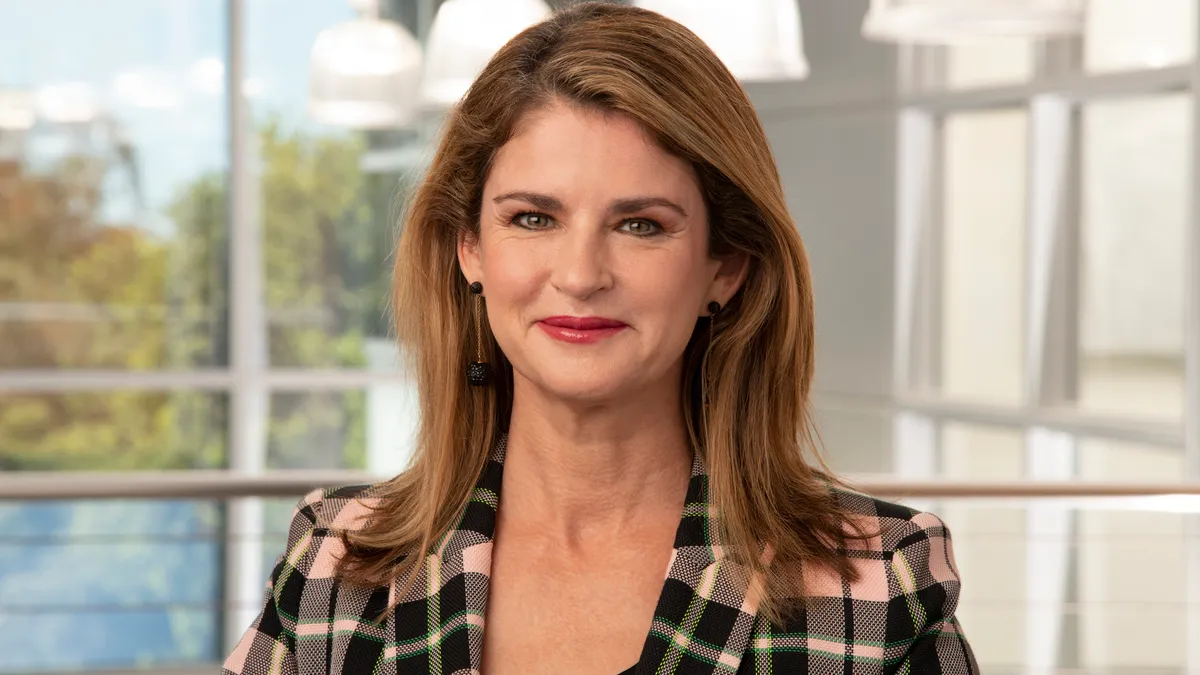

In focus with: Dr. Harith Rajagopalan, CEO and co-founder, Fractyl Health

The company’s vision: Fractyl Health is working to solve an issue emerging alongside the rising use of GLP-1 drugs for obesity: What happens to patients whose weight returns after they stop using the medications.

For Fractyl the answer could be an endoscopic procedure called Revita. The approach, which won breakthrough designation status from the FDA for patients who have stopped taking GLP-1 drugs, resurfaces the lining of the small intestine to reverse causes of metabolic disease.

Fractyl is gunning to be the first company with this type of “off ramp” option for GLP-1 patients, according to CEO and co-founder Dr. Harith Rajagopalan.

“I think we coined the term,” he said.

The challenge for previous GLP-1 users is that they often struggle with a stronger appetite once they’re off the meds and the classic options — diet and exercise — “don’t work,” according to Rajagopalan. Revita, which Fractyl was previously studying in Type 2 diabetes, may help patients keep the weight off long term. The biotech announced last month it was stopping investment in its Type 2 diabetes studies to focus on Revita, and also cut 17% of its workforce to sustain cash flow to 2026.

“If you could take a drug to get you to a weight loss, but then not have to take the drug anymore and persist at that lower weight, that would be an amazing profile,” he said. “That's what Revita is aiming to accomplish.”

Revita isn’t Fractyl’s only metabolic program. The company is also working on a GLP-1-based gene therapy for Type 2 diabetes through its Rejuva program, with plans to start human studies for the first time this year. The one-time therapy, dubbed RJVA-001, was designed to enable long-term remission of the disease.

Why it matters: Fractyl finds itself on the fringes of a booming GLP-1 market, but that wasn’t the case when Rajagopalan founded the company in 2010 and only a few GLP-1 products were on the market. A cardiologist based in Boston, Rajagopalan saw a lot of patients with obesity, Type 2 diabetes and/or cardiovascular disease.

“Even back then, it seemed pretty obvious that they were all part of one big disease complex, but we were treating them all as separate diseases with separate approaches, rather than holistically as one problem,” he said.

That line of thinking led to the Fractyl’s start with the aim of treating the root causes of metabolic diseases. Several years later, the GLP-1 market has exploded, with several options and more on the way for a wider swath of indications. The boom has created a secondary market of products and services, such as meal kits and telehealth programs with dietitians, to support patients on GLP-1s. And it’s also left a space for Fractyl to fill as the need moves beyond weight loss to a patients’ continuing care.

“I don't think anyone could have predicted how big this boom would be,” he said. “Over the past year and a half, the conversation [has been] shifting from, ‘How good are these things at weight loss?’ to ‘Why are so many people stopping this medicine and regaining all their weight? What are we going to do about durable weight maintenance?’”

All in all, GLP-1s aren’t a silver bullet for lasting weight loss, he said.

“The realization of the weaknesses of the drugs has happened way, way faster than I would have predicted,” Rajagopalan said.

The road ahead: 2025 will be a big year for Fractyl, which expects to reveal data from its open label study of Revita in the first quarter of 2025. Plus, its pivotal study of Revita to evaluate weight maintenance after discontinuation of GLP-1 drugs is expected to be fully enrolled by summer of 2025, with a midpoint analysis from patients already enrolled in the second quarter of the year, Rajagopalan said.

At the same time, the company will be entering a new stage of development for its Type 2 diabetes gene therapy, with human trials expected to initiate in the first half of the year.

"Can we continue to afford to just light our money on fire paying for drugs that people stop taking?"

Dr. Harith Rajagopalan

CEO, co-founder, Fractyl Health

Here, we caught up with Rajagopalan to learn more about Fractyl’s hard decision to pivot and how the company stands out in the GLP-1 landscape.

This interview has been edited for brevity and style.

PHARMAVOICE: Can you talk about the decision to pivot the company, including pausing investments in the Revita programs for Type 2 diabetes and the 17% workforce layoff?

DR. HARITH RAJAGOPALAN: When you're developing a therapy that can target a root cause, then it can hit Type 2 diabetes [and] also affect obesity. We had two pivotal studies ongoing in the U. S. — one was in weight maintenance for people who need to stop GLP-1 drugs, like an off ramp, and the other one was as a treatment in Type 2 diabetes. And candidly, we were seeing incredible interest and enthusiasm in the weight maintenance study. We're enrolling it way more rapidly than we've enrolled in any other study previously. The FDA granted us breakthrough device designation, which was really surprising, because there's no other drug or device that has a broad breakthrough designation in the obesity category. That highlighted the perception of the unmet need in the space.

And then we're seeing payers frightened by the cost of GLP-1s, but also by the fact that the GLP-1s are not delivering as much real world value because so many people stopped taking them. You add all that up, [and] it became pretty obvious to us that Revita’s use in weight maintenance is the biggest opportunity right now. We made a capital allocation decision to put more energy into that study, to pause our efforts in Type 2 diabetes. Weight maintenance created this acute need for a solution in an obese population that is pre-diabetic, and so it allowed us to leapfrog beyond treating diabetes to preventing diabetes potentially.

What is the commercial potential of Revita?

There are about 10 million people on a GLP-1 this year, and of them, 800,000 are getting an endoscopy already for other reasons. We're thinking about the 800,000 people annually on a GLP-1 for weight loss who are already getting an endoscopy [and for whom] Revita could be a simple add-on. And that's how we think about the commercial potential of this, at least initially.

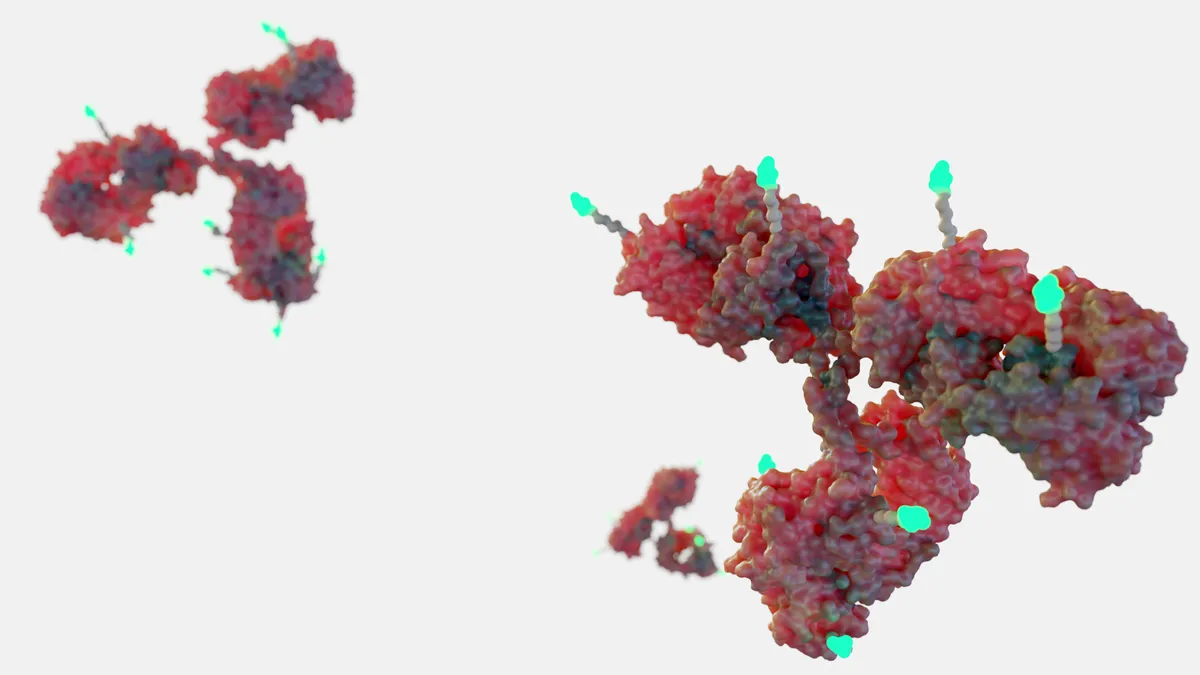

You’re also entering human studies this year for the gene therapy Rejuva to treat Type 2 diabetes. What makes Fractyl stand out in this area?

The one thing that is totally different about our GLP-1 gene therapy is that it is a smart GLP-1. We leverage the pancreas’ beta cell, the cell that makes insulin, to make GLP-1 in a physiologic way that mimics your body and my body's own GLP-1 expression. We're not just turning on GLP-1 to very high levels as if we're giving a drug, we are actually using the beta cell to make and secrete as much GLP-1 as the body needs when the body needs it, which is how your GLP-1 naturally works.

The one key difference in our approach is that we have figured out a way to deliver the gene therapy directly to the pancreas at a low dose, and what that allows us to do is to price the gene therapy in a totally different way than gene therapies that have come before. You often hear about gene therapies being so expensive to manufacture and the cost of goods being so high. That is true for much higher doses, but because we're delivering it locally, we're able to control our cost of goods so that we can imagine a pricing structure that could actually work for a very broad population.

We've developed a delivery system that [is] a needle catheter that is purpose-built to very precisely, very carefully and very reliably deliver viral vectors directly into the pancreas. That enables [us] to deliver its genetic payload into the cells where we want it to express and limit the amount of virus that enters into the circulation.

What are you thinking about the cost of the therapy?

We haven’t finalized the price … We're using a virus vector called AAV9 that people have a lot of experience with, and a lot of people have learned how to manufacture. So we feel pretty comfortable that we can manufacture this in large quantities based on existence in the field. And based on the amount we need, we think the cost is going to be sub-$10,000 per patient. The health technology assessment agency ICER has said that semaglutide is worth about $10,000 per patient per year. If you put those two numbers together, that means the cost of goods for our gene therapy is less than what a year's worth of [semaglutide] therapy would be worth.

What the challenge will be is it's a new modality, and any new modality has a high burden of proof for people to gain comfort with it. Is the world ready for that? My retort to that question would be: Can we afford not to? Can we continue to afford to just light our money on fire paying for drugs that people stop taking?