Riding a high from sales of its mpox vaccine, Bavarian Nordic strode into 2023 with one major goal in mind — to become one of the largest pure-play vaccine manufacturers in the world.

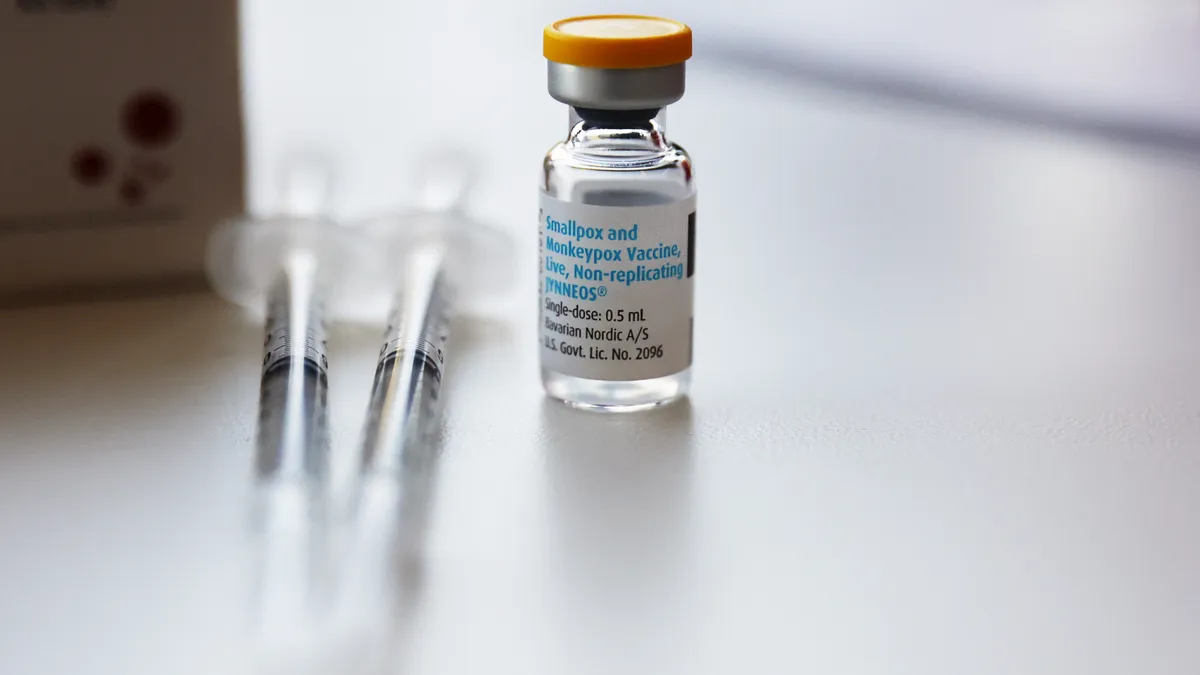

While the Danish biotech has focused on vaccines since it was founded in the early ‘90s, it’s largely relied on government contracts, including for its smallpox and mpox shot Jynneos, to stay afloat. And although the approach has proved successful — the company sold almost 5.5 million doses of its mpox vaccine to the U.S. government during the global surge of cases last summer — the business model is “lumpy,” CEO Paul Chaplin said.

“Government contracts are difficult to predict, and the timing is difficult to explain to analysts and investors,” he said. To drive growth, Bavarian pivoted in 2019 toward building a “more traditional, commercial global infrastructure,” buying two GSK vaccines for rabies and tick-borne encephalitis and dedicating its development efforts to infectious disease and cancer vaccines.

"We now have the largest travel commercial portfolio in the globe and that has led us to become a fully integrated, profitable company."

Paul Chaplin

CEO, Bavarian Nordic

Since then, the transition has been bumpy. In July, for instance, the company dropped out of the respiratory syncytial virus (RSV) vaccine race after its phase 3 trial failed to meet primary endpoints. And just a month later, the biotech ended a phase 3 COVID-19 booster program when it showed limited efficacy against new variants of the virus.

Despite the setbacks, Chaplin said Bavarian is still on track to meet its goal — optimism that’s largely propelled by the extensive travel vaccine portfolio it acquired from Emergent BioSolutions earlier this year. Among the deal’s top prospects is a phase 3 vaccine candidate for the mosquito-transmitted chikungunya fever that showed high efficacy in data published last month. For Chaplin, the vaccine represents the next stage of Bavarian’s growth.

“We now have the largest travel commercial portfolio in the globe and that has led us to become a fully integrated, profitable company,” he said of the Emergent deal, adding that a resurgence in travel demand post-pandemic “bodes well for bringing in new travel vaccines, like chikungunya.”

Here, Chaplin explains the impact of Bavarian’s phase 3 failures, the promise of its chikungunya vaccine candidate and how it fits into the company’s overall strategy for becoming a major vaccine player.

This interview was edited for brevity and style.

PHARMAVOICE: Tell me about the decision to end your RSV program after the phase 3 trial did not meet its primary endpoints.

PAUL CHAPLIN: RSV until very recently has been a bit of a graveyard for companies. We had a candidate that looked highly promising, so we went into phase 3 with some confidence. And unfortunately, as can often happen, when we read out the trial, we got mixed results. There were signals of efficacy around 50% but when we compared that to some of the earlier readouts from GSK and Pfizer, that was not in the same range that was competitive, and therefore we decided to close the program. It's a setback in terms of our future revenue growth, but the future of Bavarian Nordic didn't rely on RSV.

You also dropped your COVID-19 booster after poor results. How are you adjusting your short-term strategy as a result of both losses?

Our future strategy hasn't really changed. We're a fully integrated vaccine company that's profitable. We have a vision to continue to grow and become one of the largest pure-play vaccine companies. Depending on how you measure that, we're already there in terms of the number of products and the profit margin that we're recording. I would say our strategy is to continue on the commercial journey and add more products, either through additional acquisitions or through organic growth, and bring other products like chikungunya through phase 3 to launch.

Speaking of your chikungunya vaccine, it read out phase 3 results in August. What are some of the next steps to submit the vaccine to the FDA?

We're heading towards submitting in ‘24. The readout was highly successful, but we still have to complete other studies which we're doing. Before you can file you also have to show that you've got the commercial manufacturing under control and that's currently being finalized as well. So everything's going according to plan for next year.

I understand most people probably have never even heard of chikungunya. But the reason we're excited is that it is a huge unmet medical need. It's a horrible disease that's prevalent in South America and Asia and it can cause chronic conditions such as joint pain, which can last for years and years. And it's spread by mosquitoes, and obviously with global warming, could spread in other territories. While there is competition, our vaccine is far more active in the sense that it produces high efficacy within the first two weeks, whereas the competition takes almost a month to do the same thing. For people traveling to these endemic regions, having a fast-acting vaccine like ours is a distinct advantage. We’re excited to launch in ’25 and believe this vaccine will become the brand of choice for travelers going to Asia and South America.

You mentioned the competition. Valneva has a phase 3 chikungunya candidate heading for a PDUFA date in November. How are you thinking about positioning your vaccine versus theirs?

The competition will be the first to market as long as their approval comes through, which we anticipate. However, there's a lot of disease awareness that needs to be done. A lot of people don't wake up every morning concerned about chikungunya, even if they’re going to Asia on business or holiday. The approval is a big thing of course, but it's actually The Advisory Committee of Immunization Practices that needs to make a recommendation before the vaccine is actually taken up. That is a process that can take six months post-approval. Then the competition will have to raise awareness of the disease so that people are aware this is a problem. So we will be coming about a year after their approval. And sometimes coming second is better than being first because there's an awful lot of work and investment to be done to create the market. But then we will come second when that awareness has been raised by the competition.

Your chikungunya candidate is commonly referred to as a travel vaccine, but the disease also affects people living in parts of Africa, Asia and South America. How are you thinking about those global public health needs?

It’s critically important that we get this vaccine to the areas where it's needed. Our primary focus right now is on the European and FDA filing. However, for the endemic markets, we're looking to find a partner, a local partner, that can not only manufacture but can distribute and sell on our behalf. And those discussions have already begun.

What is the timeline for finding a partner for those endemic markets?

We know a lot of the endemic markets in Asia and South America will piggyback on the approvals either from the US or Europe. In parallel, we have already begun discussions with potential partners. Our intent is that we would firm up a partnership in the same timeframe that we look to follow up for approval sometime next year.

What are some of the mountains left to climb for Bavarian Nordic toward becoming a pure-play vaccine manufacturer? How do you compete with other, potentially larger players in the market?

If you look at the competition that we're playing with — the BioNTechs, the Modernas the Novavaxs, the Valnevas, we’re in the top bracket of those companies. However, I think it's important that you don't stagnate. We want to continue to grow. The recognition of Bavarian Nordic has grown since 2020 when we first started the true commercial journey that we are on. We saw a real wave of recognition last year with the mpox vaccine. But are we as well-known as Moderna or BioNTech because of COVID? Probably not. The way to combat that is to provide the best help to healthcare professionals that are the ones who choose which vaccines for rabies or [tuberculosis] or chikungunya and to make sure that the end users, the patients, understand which companies are providing the vaccine that they're getting. We're a relative newcomer, in terms of the commercial space, but we're not doing badly.