With two anti-amyloid Alzheimer’s disease drugs on the market, investors are on the hunt for the next big thing. After a slow start on the market, venture capitalists are now directing more funding toward new tests and biomarkers that could boost treatment and prevention.

The Alzheimer’s market, historically poised to be lucrative, has proven difficult to reach with effective treatments. The first approved drugs — Aduhelm and Leqembi from partners Biogen and Eisai, and Kisunla from Eli Lilly — haven’t made as much of a dent as expected, with one being pulled from the market and the other two riddled with concerns about efficacy, safety, cost and the burden of treatment.

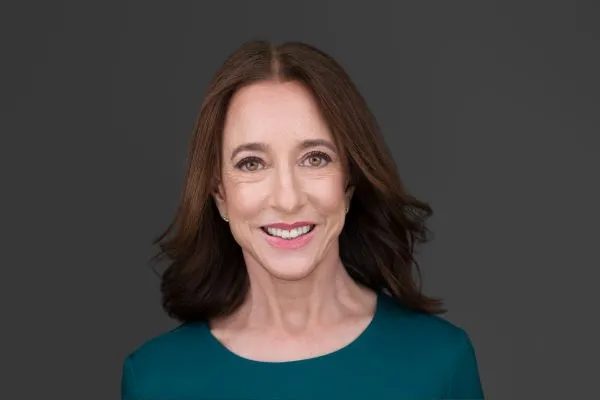

But the clinical landscape is buzzing with new opportunities, said Karen Harris, CFO and head of mission related investing at the Alzheimer’s Drug Discovery Foundation, a venture philanthropy organization funding clinical and preclinical research. Venture capitalists, philanthropic and otherwise, are eyeing the space with renewed optimism, she said.

“VCs are starting to get interested in Alzheimer's,” Harris said. “It's a very risky area, but maybe, just like cancer 20 years ago, they see that things are happening, and they don't want to miss out.”

In the diagnostics and biomarkers arena, the ADDF has some big backers — including billionaires like Leonard Lauder, Bill Gates and Jeff Bezos, organizations like the NFL Players Association and the Shanahan Family Foundation, and industry players like Biogen and Lilly. All told, about $100 million has been set aside since the accelerator started in 2018 for companies working on new detection methods for Alzheimer’s.

Funding new spaces

One of the companies with funding from the ADDF collection is C2N Diagnostics, which has developed a test with 90% accuracy to detect amyloid plaques from a blood draw that can be done at the doctor’s office, Harris said. Normally, more cumbersome tests like a PET scan are required to determine the presence of amyloid.

While much of the industry’s R&D has long been focused on amyloid, Harris said it’s time to track other pathways.

“Pharma companies were so focused on amyloid that we decided to spend our money outside of that,” Harris said. “It turned out that the amyloid drugs are only partially effective, and for the future of Alzheimer’s, we’re going to need to develop an arsenal of novel drugs guided by the biology of aging.”

Two companies with multi-targeted diagnostics are Fujirebio and Alamar Biosciences, each with tests that can give a bigger picture of a patient’s susceptibility to Alzheimer’s and potential treatment regimens.

Fujirebio’s blood test for tau, another protein that “tangles” in the brain and is potentially linked to Alzheimer’s, is the first to be filed with the FDA, Harris said. Fujirebio has partnered with companies such as Biogen to bring the test to market.

Alamar similarly has a test that’s sensitive to tau proteins in the blood as part of a panel that can discover a wide range of targets that includes alpha synuclein, which is supported by the FDA as a biomarker for Parkinson’s — a disease with a notable lack of targets.

Another company backed by ADDF, Amprion, also has a multi-faceted test that finds synucleins in the blood for early detection of Alzheimer’s and other forms of dementia, as well as Parkinson’s.

Lifelines

The truth is that $100 million isn’t enough to fund all the trials necessary to find diagnostics and therapeutics for Alzheimer’s — a late-stage study can cost $300 million or more, Harris noted.

But venture philanthropy can point investors in the right direction, particularly when markets aren’t up to the task.

“Venture philanthropy was a lifeline for many companies during the biotech downturn because we can take more risk than other VCs,” Harris said. “So we did a lot of bridge rounds for companies raising capital when they just couldn’t do it. It’s a stamp of approval that helps them gain future financing.”

And companies at the forefront of innovation, like the Biogens and Eli Lillys of the world, are branching out to the next generation of treatments beyond amyloid antibodies, Harris said.

“Pharma needs to keep their research pipelines going,” Harris said. “And they’re going beyond amyloid into the bigger thesis of the biology of aging, and there’s a lot of low-hanging fruit.”