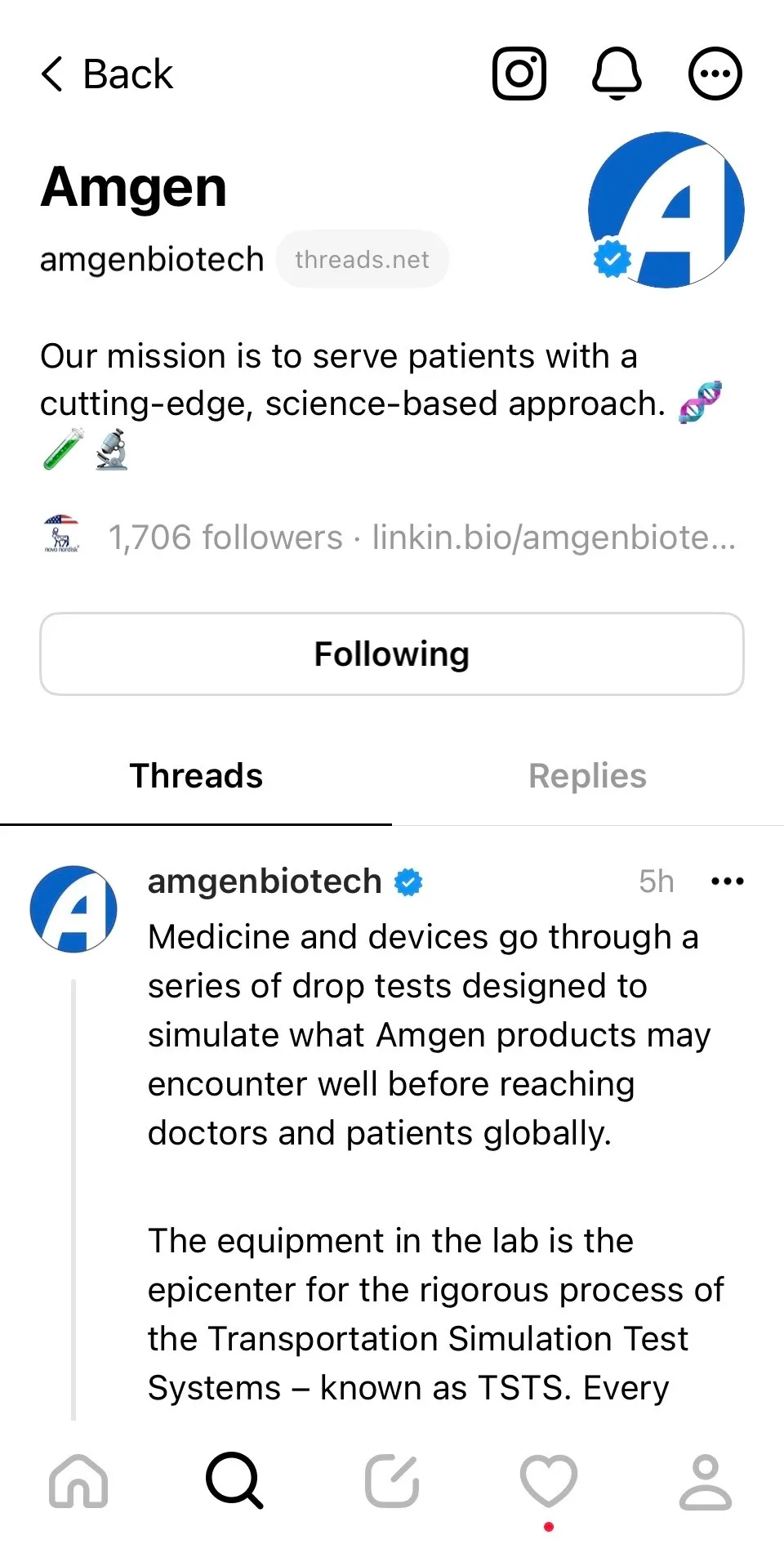

After just a few weeks, Meta’s Threads app has amassed more than 114 million users, making it the fastest growing social media platform ever and raising questions over whether it could be a legitimate competitor to Twitter.

Despite the pharma industry’s reputation as a notoriously slow adopter of new marketing tactics, many players are wrapping themselves in the Threads spool including Amgen, Vertex, Alnylam, Bayer and GSK, which created profiles on the platform within 48 hours of its launch. Other large pharma’s have followed, including AstraZeneca, Genentech, Gilead, Boehringer Ingelheim and Novo Nordisk, which has three verified Threads accounts — NovoNordisk, NovoNordiskUS and Team Novo Nordisk.

What’s behind the rapidly building intrigue? Many in the marketing space are wondering if the new app could provide a safer haven for companies that stopped advertising and engaging on Twitter earlier this year as a result of perceived risks to brand reputation.

The app is almost identical to Twitter — it features a simple white home feed where users scroll through 500-character limit posts and like, comment, repost or quote, and externally share content. Many posts on the site feature photos and videos, too.

Other sites, like Mastodon and BlueSky, popped up as early contenders to replace or augment Twitter, but quickly fell to the wayside. Threads, on the other hand, is backed by the biggest social media company in the world. If the user counts on Meta’s other apps are any indication — 3 billion on Facebook and 2 billon on Instagram and WhatsApp — then Threads could pose the biggest threat yet to Twitter, which has a little over 353 million annual users.

“As the early adopters jump on the platform, we should see growth slow down, but not stop because you're going to hit that bell curve,” Brad Einarsen, senior vice president of social media at Klick Health, said. “If that's true, Threads could be on a journey to 500 million, 1 billion people over the next year.”

Still, Threads hasn’t quite figured out its place in the labyrinth of social media options. For instance, it currently only exists as a mobile app with no desktop website and doesn’t allow advertising. Users must also sign up through a connected Instagram account.

However, Meta executives, including Instagram CEO Adam Mosseri noted recently that changes are coming to the app. For pharma marketers, that means sitting tight.

“This is probably the most attractive new platform we've seen for a long time,” Einarsen said. “And because it's tied to a company with a track record of success in social pharma, marketers should closely watch this platform, wait for the right time for their brand and then be ready to engage by extending their existing social media.”

For now, here’s what companies should consider when taking the leap to communicating with patients and healthcare practitioners (HCPs) on Threads.

Advertising to patients

One of the biggest questions looming for marketers interested in capitalizing on Threads is if Meta will bring advertising capabilities to the site. However, Einarsen said it’s likely more a question of when, considering Meta’s prior track record.

“This is Meta. They're going to want to grow their audience. They're going to create a space where people want to engage, and then they'll want to monetize that,” he speculated.

Assuming that advertising is added, it will likely be pharma’s best way to reach patients on the platform, as organic communication “remains a difficult play,” for the industry, Einarsen said. Because Meta already has a centralized platform for managing paid media, advertising on Threads also likely won’t be a heavy lift if it is added.

But life sciences companies shouldn’t wait until Meta allows advertising to join. By pharma marketers can watch how conversations evolve, what culture develops and how certain styles of content perform now to design effective campaigns later.

“You don't want to jump on with content immediately, you want to feel it out and see how it develops over the next few weeks,” Einarsen said, noting that: “sometimes pharma’s approach of being first to be second is a good one.”

If Meta’s goal of keeping “politics and hard news” off the site and making it a more positive “public square” than Twitter holds true, as Mosseri recently suggested in a Thread, the platform could be a good place for brands to park.

“That's fundamentally a good news story for (pharma) because Threads is attempting to focus on safer, less controversial topics,” Einarsen said, noting that companies will need to worry less about where their ads appear.

Another update pharma marketers should watch for is whether Meta will fulfill its intention to support ActivityPub, a decentralized and federated open-source version of social media on which platforms like Mastodon are run.

“If that happens, that would be very interesting for marketers, because now you could find communities developing on these smaller platforms,” Einarsen suggested.

And, he said, navigating the ActivityPub likely wouldn’t take too much effort.

“On the surface, we might feel like oh, there's so many new things we have to pay attention to but each one doesn't take a lot of overhead,” he explained. “Marketers can still use their existing brand plans and add on slight changes for experiments on these other platforms.”

Engaging HCPs

Targeting HCPs could pose more of a challenge because it’s still unclear how Meta will moderate or treat scientific discourse on the platform.

"Marketers should closely watch this platform, wait for the right time for their brand and then be ready to engage by extending their existing social media."

Brad Einarsen

Senior director of social media, Klick Health

Right now, many HCPs still congregate on Twitter to share and discuss medical research. And if Threads doesn’t provide a welcome environment or the right tools to help researchers facilitate those interactions, doctors may be less inclined to make the switch.

“Doctors aren't big fans of change and overhead. They don't have time for things,” Einarsen said. “So, asking them to move to a new platform, especially if they don't have an Instagram account, will be iffy.”

Anni Neumann, a principal consultant at Creation.co, a life sciences communication strategy firm, said she’s already seen doctors point out that Thread’s lack of hashtags and a desktop browsing option could be deterrents from joining.

But some while doctors could transition to the platform slowly, those who jumped on TikTok and Instagram to communicate to patient-centric audiences, rather than to research-based peers, might migrate more quickly.

“We are seeing that senior physicians are still on Twitter. On Threads, because of its integration, most of the early adopters are the physicians who are already engaging on Instagram,” she said.

Another possibility is that “younger doctors who are on Instagram could move over (to Threads) and older doctors stay on Twitter,” Einarsen predicted.

The key will be evaluating how many doctors make the switch, and whether they begin exclusively using Threads. Until then, companies should monitor on both platforms.

“We want to see how many of our Instagram doctors, let's call them, make the move. And how many of our Twitter doctors who don't have Instagram (make the move),” Neumann said.

If discussions begin to originate on Threads, rather than just being merely cross posted between platforms, that could signal a major shift.

In other words: “If the scientific discourse moves to Threads, then doctors will move to Threads,” Einarsen said.